Payment problems are an unfortunate reality in the construction industry, and almost every contractor or supplier has experienced a payment issue in some form or another. Many look to mechanics liens (aka construction liens) to protect themselves. And why not? Mechanics liens are an incredibly powerful tool to protect your right to payment. The problem is, that many times people attempt to navigate the murky waters known as the mechanics lien process on their own, and mechanics lien mistakes happen all the time!

This isn’t totally surprising, as those in the construction industry are used to building things, fixing things, and getting things done on their own. Sadly, this can-do attitude can end up creating more problems than it solves.

It’s easy to make an expensive mistake when it comes to mechanics liens. In an effort to help ease this process, we’ve compiled a list of the 4 most common mechanics lien mistakes people make when trying to manage a mechanics lien filing on their own.

Video Summary of the 4 Worst Mechanics Lien Mistakes by Contractors and Suppliers

1. Filing a mechanics lien when you don’t actually have lien rights

Just because you went unpaid on a construction project, doesn’t automatically mean that you are allowed to file a mechanics lien on the property. In general, all parties that perform work or supply materials for the permanent improvement of the property can file a mechanics lien to secure payment for that work in every state in the country.

However, there are requirements and exceptions that occur on a state-by-state basis which may preclude your ability to file a mechanics lien claim. The following are just a few of the most common requirements that may come into play, depending on your specific situation and circumstances.

Failure to meet preliminary notice requirements

The vast majority of states require some form of preliminary notice. And this can be called a number of different things depending on the state; pre-lien, notice to owner, 20-day notice, notice of furnishing, and some don’t even have a name for it (we’re looking at you Texas “monthly notices”)!

Regardless of what you want to call them, if you are working in a state that requires a preliminary notice, and you fail to send one, chances are you’ve lost your lien rights before the project even gets started!

For a deep dive on this issue:

The next logical question is, What Do I Do If I Miss a Preliminary Notice Deadline?

Even within the states that require a preliminary notice, the deadlines and applicability vary. Some states have hard deadlines, if you miss it, no lien rights. Others merely require that it be sent before a mechanics lien is filed. Lastly, there are some states, such as California and Arizona, where a late notice is still valid. However, it only offers lien protection for the labor or materials furnished in the few days preceding the notice.

Nevertheless, whether you are in a state that requires a preliminary notice or not, we always recommend sending one on every project. Preliminary notices serve more functions than merely securing lien rights. They also promote visibility on the project; that way, those that are higher on the payment chain know who you are and what services you are providing.

Merely remembering to send a preliminary notice isn’t quite enough. There are other factors to consider to make sure you preserve your lien rights. This includes:

- Sending the notice to the required recipients;

- Using the proper delivery method; &

- Including the correct information on the notice itself.

All in all, that’s a lot to manage; especially if you are trying to take on the entire mechanics lien process on your own.

Taking the project type and role into account

Depending on the type of project, and your specific role will determine which lien claim and form you’ll need to use. One of the most common mechanics lien mistakes is preparing the wrong type of claim.

“Project Type” in this context is all about determining whether the project is public or private. A public project means that the project is being funded by state or federal funding. This covers not only government-owned land but also any city or state schools and universities as well. Private projects cover essentially any other type of construction project; typically commercial or residential projects.

Generally speaking, the remedies available for non-payment on construction projects are:

- Mechanics lien claims for private projects; &

- Payment bond claims for public projects.

Find out more:

- Types of Construction Projects & Why You Should Care

- What’s the Difference Between a Lien Claim and a Bond Claim?

“Project Role” is another important factor to consider. This refers to whether you are a prime contractor, subcontractor, material supplier, equipment lessor, etc. Typically primes, subs, and suppliers are given lien rights, but this can vary depending on the state. One notable exception that pops up in a fair amount of states is that material suppliers to suppliers are unable to file a mechanics liens.

Being unlicensed in a state that requires one

Licensing is another key issue in determining whether a lien claimant is allowed to file a valid mechanics lien. If the party (usually contractors and subs) is required to be licensed to do that type of work in a particular state, a majority of states will not allow them to file a mechanics lien.

Some states don’t even allow unlicensed contractors to pursue actions for non-payment apart from the mechanics lien process. Best practice? Always get your license if it’s required!

2. Using incomplete or incorrect information

Mechanics liens are recorded and filed by state officials. Depending on your state, this could be the county recorder’s office, the county clerk of the court, and others. The problem is that lien claims can be rejected by these offices for any number of reasons; such as typos, document margins, and even something as placing an address on the wrong side of the page. One simple mistake on the lien claim form can completely invalidate the entire lien claim.

In addition to these issues, the requirements for the information you need to include in the lien are typically very strict. Here are some of the most common mechanics lien mistakes our customers have encountered time after time:

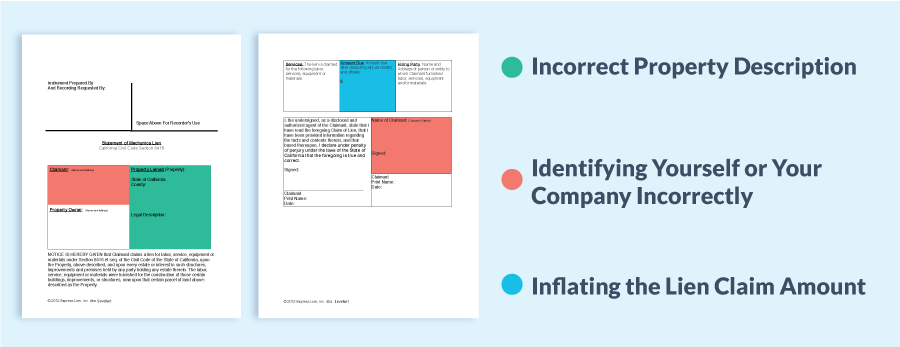

Incorrect property description

Identifying the property in a mechanics lien form is far more complicated than it appears to be. Simply jotting down the address, just won’t cut it in most states. Many require that the claimant include what is known as the Legal Property Description. This can include anything from the block, lot, or parcel numbers, full metes and bounds, references to recorded legal documents, and the municipal address.

Even if it’s not a specific requirement, it’s always a good idea to throw in as much detail as possible. You’d be surprised at how often an identified address on a building doesn’t match up to the city or state records. Or worse, confused with another property on a similar street. Think E. First Street, W. First Street, & First Street.

The #1 reason liens get rejected: Bad information.

Learn more about job research team. We'll track down and verify all of the job information you need to complete your form and file a valid mechanics lien.

Incorrect personal information

This section is meant to be a gimme. But it’s incredibly easy to mess this one up. Don’t go invalidating your lien claim because you got your information wrong! If you are filing the lien on behalf of just yourself, put your entire name down. No short versions (i.e., Alex instead of Alexander) and no nicknames. Whatever your driver’s license says, put that down!

If you are a sole proprietor, this means you don’t have a legally recognized company; instead, you are an individual doing business under some type of trade name. Let’s say your name is Leon Spinks, and you operate “TKO Demolition,” which was never registered as a specific business entity (i.e., Inc., LLC, etc.). The full legal name of your company would be “Leon Spinks doing business as TKO Demolition” or simply “Leon Spinks d/b/a TKO Demolition. Be cautious about identifying yourself as “Leon Spinks” or “TKO Demolition” on any legal document; let alone your mechanics lien claim.

If you are filing on behalf of a business entity, then you should know what to do here by now. One fatal mistake would be to forget to include the business entity designation in your business name. For the most part, the company you work for (or own) is either a Limited Liability Corporation (LLC), a Corporation (Co., Corp., Ltd.), a Limited Partnership (LP) or some other form of registered business entity. Be sure to include the business designation in your company name. For example, Nike isn’t the full business name; it’s Nike, Inc.

All in all, the most important thing you can do when identifying yourself or your company is that you stay consistent! You can avoid most of these silly mistakes by using the full company name, every time you write it out. Get in the habit of doing it. This can help you in more areas than just mechanics lien rights.

Insufficient description of labor and materials

There are a number of states that require a “general description of labor or materials provided” to be included in the claim of lien form. However, the statutes in these states don’t provide much guidance on what constitutes a “sufficient description.”

Although county recorder offices charge you per page, the more information you provide the better. Simple descriptions such as “electrical work,” or “roofing supplies,” just won’t cut it. This is a quick way to get your lien rejected.

Exaggerated lien claim amount

This is another section of a mechanics lien claim form that seems pretty straightforward. The lien amount is the amount of money you’re owed… right? Well, as with most things in the legal realm, it’s more complicated than that. When determining how much money to put down on your lien claim, it’s important to think about the specific expenses associated with the project, and which ones shouldn’t be included. Just because you think you may be owed some money, doesn’t necessarily mean it’s covered under mechanics lien law protection.

What can and cannot be included varies depending on the state. Some states specifically allow for the inclusion of interest, while others keep this amount incredibly restricted. And in Florida, for example, finance charges can be included.

We even wrote an entire article on whether you can include attorney fees in your mechanics lien. Deciding how much money to put on your claim comes down to knowing your state’s specific requirements.

This is a question that comes up all the time in our Expert Center:

- Can I include attorney fees, interest, and filing costs in my California lien claim?

- Can legal fees and interest be included in the total contract amount in New York?

- Were we wrong to include the retention amounts in the lien value in Texas?

Retainage, attorney fees, collection costs, interest, and other amounts are all tempting prospects to be included in your lien claim, but be careful. In most states, the answer to whether these can be included or not Exaggerating the lien amount can not only invalidate your claim but could also make you potentially liable for filing a fraudulent mechanics lien.

That’s not to say that these amounts can’t ultimately be recovered — particularly attorney’s fees. In fact, most states will award costs and attorney’s fees to the prevailing party in a foreclosure lawsuit.

As a general rule of thumb, when deciding your lien claim amount, it should only be the reasonable value of labor and materials provided to a project that is owed. Any “unearned amounts” or other costs and obligations may be better suited in a separate legal action.

3. Missing your deadline by filing too late or not foreclosing

This is possibly the biggest mechanics lien mistakes that a potential claimant can make. There is an alarming amount of contractors and suppliers that operate under the impression that they can file a mechanics lien at any point in time, as long as they are unpaid. And that’s simply not the case. The fact of the matter is that all states require that mechanics liens be filed within a certain period of time.

Calculating your lien filing deadline

The two main points of concern regarding the deadline to file a lien claim are:

- How long is the deadline to file? &

- When does the clock start ticking?

The second question is the one that causes many in the construction industry headaches. Particularly if they are working across state lines, each state answers these questions differently, so knowing when the clock starts is just as important as knowing how long the deadline is.

Generally speaking, the deadline to file your lien claim is measured by one of three methods; (1) the last day the claimant furnished labor or materials to the project, (2) the completion date of the entire project, or (3) some combination of two of them.

Do you think this sounds confusing? You’re not alone; we get this question all the time:

- Does the project completion date mean the date that you completed your portion of the work, the date the project was substantially complete, or the date when the entire project is fully complete?

- Do punchlist items extend the completion date?

- Is the last date of furnishing the day when the materials left our yard or the date they were delivered to the job site?

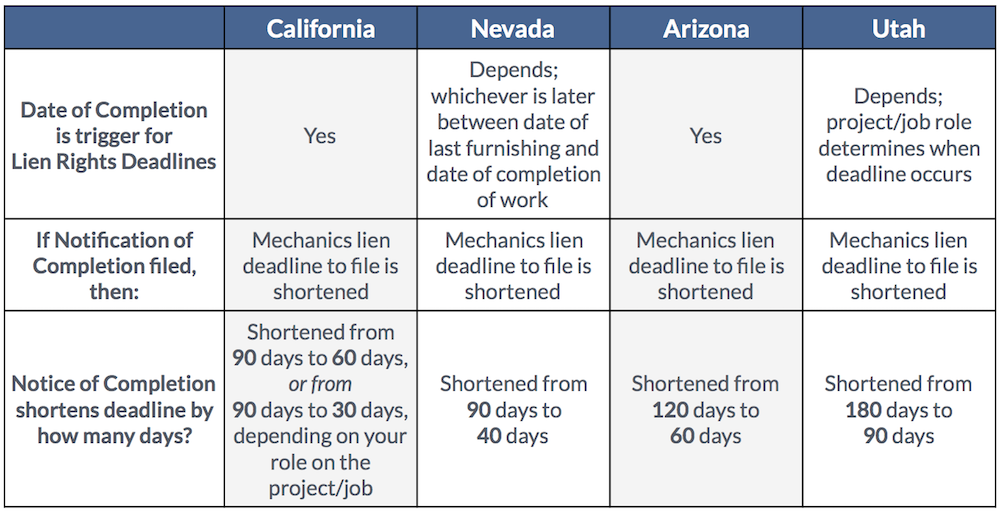

In some states, owners can shorten your deadline

To make matters worse, there are many states that allow the owner to shorten this deadline if they so choose. This is referred to as a Notice of Completion. As you can see from the chart below, if the owner decides to file one of these, it can drastically impact your timeframe to file a lien claim. You’ll need to be ready at all times to spring into action if necessary.

Enforcement deadlines

Once you’ve filed your mechanics lien claim, that’s not the end of the story. There is also a deadline to enforce your lien claim should you remain unpaid. Once the deadline has passed, the lien claim will automatically expire, and will not be enforceable.

And, just like the lien filing deadline, this can also be shortened by the owner if they choose. In states such as Florida and Georgia, property owners have the option of filing a Notice of Contest. This is essentially the property owner saying, “I don’t believe you have a valid claim, I’m going to call your bluff.”

It is crucial to keep a close eye on your deadlines and look out for any actions that may affect the timeline. Mark your calendar, set the alarm, tie a ribbon around your finger, whatever you need to do; just make sure you don’t miss it!

4. Failing to send a Notice of Intent before filing the lien

The thing you need to remember about mechanics liens is that filing a lien claim is a pretty serious step! A lien can cause cardiac arrest on a project; it can cause a ripple effect across the entire project and bring construction to a screeching halt. While filing a lien may indeed be an ideal and necessary step, this should only be done after all other avenues to get paid or resolve the dispute have been exhausted.

One of these other avenues is to fire a final warning shot across the bow. This can be accomplished in the form of a Notice of Intent to File a Mechanics Lien (NOI) before actually filing your claim. This gives the other party one last time to fork over payment before you decide to take the more drastic action of filing a lien. Failure to provide this extra opportunity to resolve the issue could be considered a big mechanics lien mistake.

By sending a notice of intent to lien, you are escalating your dispute to the top-tier, and that’s where the money is! Everyone involved in the project is trying to avoid a lien being filed on the property and will help to apply pressure to the non-paying party. A notice of intent is usually enough to get the message across that there’s a problem that needs to be fixed. Trust us, we’ve crunched the numbers. More than 47% of notices of intent to lien are paid within 20 days, and Levelset users with an NOI policy in place see 90% of their NOIs get paid within 90 days. All things considered, those are some pretty good odds!

Other lien mistakes

These aren’t the only mistakes that can get a mechanics lien claim dismissed – just some of the most common ones. Getting the details on the form itself is critical, as is filing the right documents in the right place to protect your lien rights. Check out some of these other articles regarding lien mistakes:

- In Florida, several contractors filed their lien in the wrong county, likely confused by properties that were close to a county line.

- In New Jersey, the wrong person signed the mechanics lien form because was unauthorized to do so.

Getting paid in construction can be hard. It can be even more frustrating when simple mistakes derail a mechanics lien claim, putting your construction payment in jeopardy.

Ready to file a mechanics lien? Levelset is here to help!

Levelset’s payment and legal experts have helped thousands of contractors file lien documents across the United States. The best way to avoid making mechanics lien mistakes is to use a service like Levelset to file your mechanics liens.

Instead of having to navigate the waters yourself to figure out what forms to file, what goes on the forms, and more. Levelset asks you simple, easy-to-understand questions about your business and the construction project at issue. All you need to do is answer those questions, and the system prepares your lien claim and has it electronically recorded.

Additional mechanics lien resources, FAQs, & deadlines for all 50 states