One of the biggest misunderstandings about mechanics liens is that a lien is more than just a document — it’s a process. And given that, some steps must be taken before you can file a mechanics lien and actions that are required as part of the filing process itself. Keep reading to learn the 4 steps to take after filing a mechanics lien.

Video: 4 Steps you should take after filing a mechanics lien

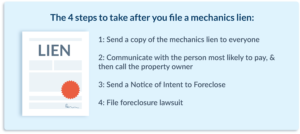

The 4 steps to take after you file a mechanics lien

If you’re reading this, you ran into one of the most prevalent issues in the construction industry, payment problems. Hopefully, you’ve taken the right steps by sending any required preliminary notices and filing a mechanics lien to ensure you get paid what you’ve earned. But then what? Let’s take a look at the 4 steps that every lien claimant should take after filing their mechanics lien.

Step 1: Send a copy of the mechanics lien to everyone

When you file a lien on a construction project, it attaches to the property itself. And who owns that piece of property? Well, the property owner of course! But that doesn’t necessarily mean the owner is going to find out that you filed a lien. There’s a serious visibility issue on constructions projects, and if you are a lower tiered subcontractor or material supplier, the owner may not even know you’re having payment problems.

In many cases, state law mandates that mechanics liens be served upon certain parties like the property owner or the general contractor. You should comply with these requirements of course — but also go a step further by sending copies of the mechanics lien to all potentially interested parties, including subcontractors, construction managers, property managers, lenders, and more.

The magic of the mechanics lien is that it gets multiple parties involved with your debt, and everyone on the project will take notice. That’s because payment problems can easily spread like wildfire to the rest of the project. Sending the lien claim along to these parties ensures that everyone on the project knows. The more people you send a copy of your mechanics lien to; the more people are aware of your payment problems.

Once you start distributing the mechanics lien claim, give it a little time. You want to give the mail service a chance to deliver the lien, and then give each recipient some time to review the claim and to talk about it internally.

By the way, if you filed your mechanics lien with Levelset, you could skip this step because we send copies of the liens we file to all interested parties on a project.

Step 2: Communicate with the person most likely to pay, & then call the property owner

Once you’ve given the mechanics lien claim some time to get distributed to everyone on the project, it’s time to pick up the phone. You’ll want to do some follow up phone calls with some of the key parties. At this point, communication is crucial to settling the dispute without having to resort to more drastic and expensive measures.

Reach out to the person who hired you

The most important party here is the person or company who is most likely to pay you. Typically, this is the party that hired you to work on the project. While they may have been tough negotiators before, filing the mechanics lien has probably shifted the leverage in your favor.

Most construction contracts contain a clause that requires them to keep the property “clear and free of any liens or other encumbrances.” Thus, allowing a lien to be filed, that could have been prevented by the hiring party, can place them in breach of contract. Even without this clause, the owner will eventually go after the hiring party if you have a lien filed on the property. For more information on this check out: Does a mechanics lien cause a breach of contract?

At the very least, you can be sure that you now have their full attention! Talk to them and see what their payment plans are now that you have a valid lien claim hanging over their heads.

Talking to the property owner

If that conversation goes nowhere, or if you just want to make sure the pressure stays on, give the property owner a call as well. While many folks in the construction industry understand the mechanics lien instrument, property owners aren’t always as informed. Explain to the owner that you’d rather not have been forced to file a lien in the first place, but you were facing a non-payment situation and had to take appropriate steps.

You can also tell them that you’d rather not have involved them in the situation at all, but if you don’t receive payment, you’ll have to enforce your lien against the owner directly. Since it’s their property on the line, this usually gets their attention. Property owners hate mechanics liens, it clouds the title and locks up the property from being refinanced, sold, or otherwise transferred.

Phone calls and emails are important and you should give them time, but if talks are dragging on for longer than 10-14 days without any payment commitments, you may want to move onto the next step.

This is no time to be shy! If, during this process, you are worried about coming off aggressive or jeopardizing your business relationships, just remember:

You are not the one at fault here. Someone decided not to pay you! Don’t apologize, and don’t make excuses. This wouldn’t be happening if you had been paid to begin with. All of this will go away as soon as you get paid the money you already earned.

Step 3: Send a Notice of Intent to Foreclose

Consider this notice a final warning shot to all of the interested parties on the project. A Notice of Intent to Foreclose tells the party that they have one more opportunity to pay or your mechanics lien will be foreclosed upon. This helps to demonstrate that not only do you know your rights, but you’re also willing to enforce them if need be.

Download Levelset’s free, customizable Notice of Intent to Foreclose template here.

At this point, mark a reasonable amount of days (typically around 7) on your calendar for them to respond. Make another phone call or send another email if you think it’s worth it. If that date comes and goes with no payment plan set up, it’s time to move onto Step 4.

Step 4: File foreclosure lawsuit

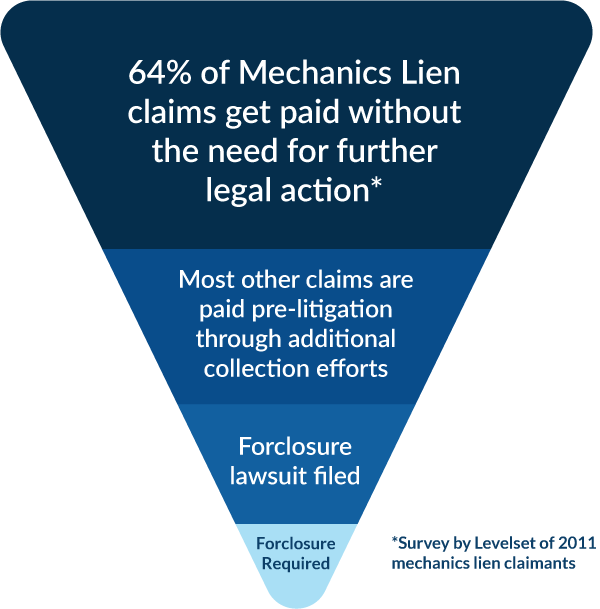

Most mechanics lien claims get paid before a foreclosure action is ever required. However, there are some instances when none of the above measures work, and foreclosing on your lien claim is necessary.

While you may be unfamiliar with foreclosure lawsuits and the legal process in general, that’s not a reason to let your mechanics lien claim expire and to just write off this debt. The debt may have its challenges, but it is not dead. Just as the mechanics lien filing is effective at getting most companies paid, escalating a lien claim to a foreclosure action is successful at getting most of those types of debts paid.

To file a foreclosure action, you’ll need to hire an attorney because, after all, this is a lawsuit. In most cases, even if your claim value is very low, this is not something you can pursue in small claims court alone. Also, in many states, if you are succesful in your foreclosure, there is the possibility of recovering attorney fees and court costs.

You can read more about lien foreclosure here: Is Foreclosure with a Mechanics Lien Worth It?

One final thing to remember: Every state has a deadline to enforce a mechanics lien claim. Be sure to know the deadline in the state where your project is located. Missing your deadline means losing all leverage you managed to build up by filing the claim in the first place. To find out when the deadline is in your state, you can check out our Mechanics Lien Enforcement Deadline Heat Map.

Additional mechanics lien resources

- How to File a Mechanics Lien in any State

- How Do Mechanics Lien Actually Work?

- What Are Lien Rights?