The Miller Act is hugely important to subcontractors and suppliers when it comes to getting paid on a federal construction project. But do you know what the Miller Act is, exactly?

The article will give you the breakdown of how to make a Miller Act claim and how it impacts your payment rights on federal construction projects.

What Is the Miller Act?

All federal construction improvements — and more specifically, all payments made on the project — are regulated by the Miller Act, a U.S. law that was passed in 1935. The act mandates that before any contract of more than $100,000 is awarded for the construction, alteration, or repair of any public building or public work of the Federal Government, the general or prime contractor must furnish to the Government a payment bond and a performance bond.

Payment Bond and Performance Bond Requirements

Although a payment bond is provided by the prime contractor, it’s for the benefit of the subcontractors and suppliers working under the prime contractor on the federal project, guaranteeing that they will be paid for the labor and materials that they furnish.

The performance bond is between the prime contractor and the federal government and guarantees that the prime contractor will finish (“perform”) the project according to the contract.

It’s important to note that the Miller Act provides no protection for general contractors. Additionally, the Miller Act does not protect subcontractors or suppliers lower than the second tier. This means that first-tier contractors, second-tier subcontractors, first-tier suppliers (those suppliers under contract with the general contractor) are all covered by the Miller Act if they encounter a payment issue while working on a federal construction project.

Miller Act Quick Takeaways:

- Federal Construction Projects: The Miller Act only applies to federal construction projects. It does not apply to commercial projects, private projects, or state or county projects. Therefore, the first thing you need to know about the Miller Act is whether the Miller Act applies to the project you’re working on. If it isn’t federal, then the answer is no. Learn more about project types.

- Prime Contractors: If you are the prime contractor, you cannot bring a payment claim under the Miller Act. Instead, you have a contract claim against the government and must bring a lawsuit against it. The Miller Act deadlines are not applicable, and you should consult with an attorney to discuss your claim.

- Subcontractors and Material Suppliers: The Act covers first and second-tier subcontractors, first-tier suppliers, and second-tier suppliers under contract with a first-tier subcontractor, but not those second-tier suppliers under contract with another supplier (aka “suppliers-to-suppliers”). Third-tier suppliers and subcontractors are not covered by the Miller Act either.

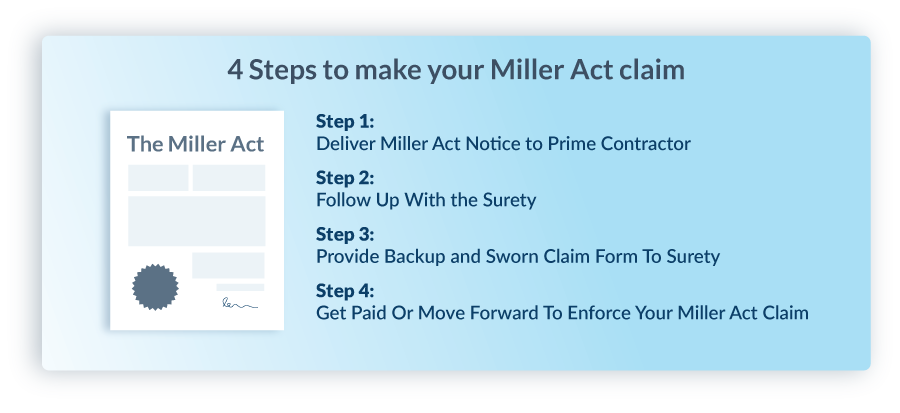

How Do I Make a Miller Act Payment Claim? 4 Steps to Make Your Claim

The Miller Act mandates that a payment bond “stands in the place of the federal property,” such that if anyone furnishing to the project goes unpaid, they can make a claim directly against the bond and receive payment from the bonding company if their claim is successful. Typically, the bonding company will investigate the claim and request backup, and thereafter, the claim will be paid either by the prime contractor or the bonding company.

Unlike many state projects, county projects, and private projects, you do not need to comply with any notice preliminary requirements to qualify to file one of these bond claims. All you need to do to file your claim within 90 days of when you last furnish labor or materials to a project.

So, it’s simple. Ask yourself this question: Did you provide any labor or any materials on a federal construction within the past 90 days? If the answer is yes, you can likely file your Miller Act claim and get paid. Here is a generalized, step-by-step guide regarding how to make a Miller Act claim.

Step 1: Deliver Miller Act Notice to Prime Contractor

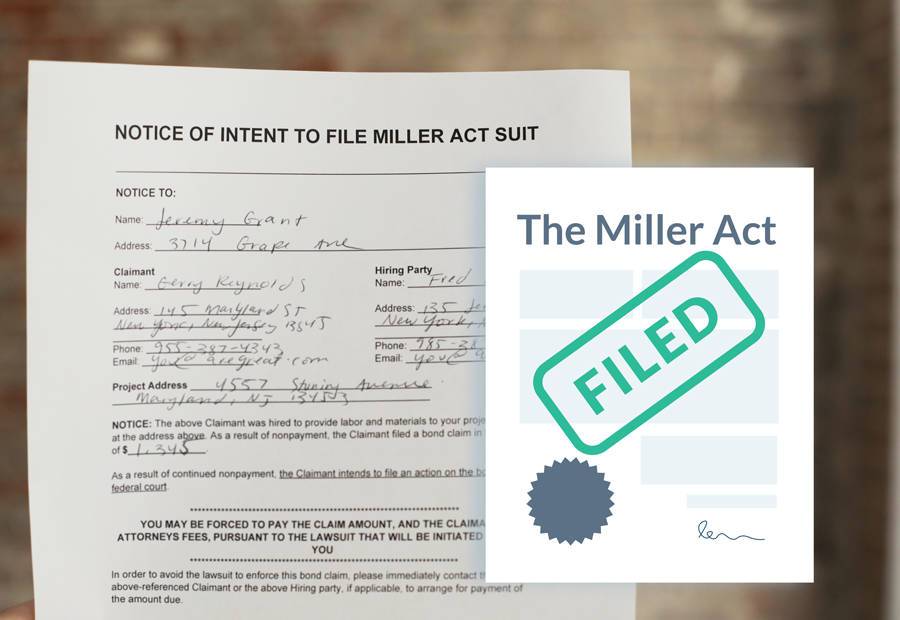

The first step to making a Miller Act Claim against a federal construction project is to deliver your payment claim notice to the prime contractor. (Note: the “claim notice” is a notice of the claim itself — it’s not the same thing as a preliminary notice.)

Any party who did not contract with the prime contractor directly is required to deliver this claim notice to the prime contractor within 90 days from their last furnishing of any materials or labor to the project. Those who did contract directly with the prime contractor is not restricted by this deadline, but it is a good practice to deliver a claim notice to the prime contractor within this time period or a reasonable time.

The claim notice should be delivered to the prime contractor by certified mail, return receipt requested, although the law allows the notice to be served “(A) by any means that provides written, third-party verification of delivery.”

The Miller Act’s § 3133 provides the notice “must state with substantial accuracy the amount claimed and the name of the party to whom the material was furnished or supplied or for whom the labor was done or performed.” The statute does not give any other details about what should be in the Miller Act claim notice, nor does it provide a statutory form.

Step 2: Follow Up With the Surety

Interestingly, the US Miller Act does not require that you notify the government organization commissioning the work at the project or the prime contractor’s surety. Instead, claimants are simply required to notify the prime contractor of the claim, and it is the prime contractor’s duty to forward notice of the claim to the bonding company.

The next step in the Miller Act Claim process is to get some type of response from the Surety company because you must provide them with a sworn claim form and claim back up to help them process the claim. You need to make sure the Miller Act Claim Notice gets to the surety as quickly as possible, therefore, to get this ball rolling.

That’s why we’ve previously written that it’s a good idea to send your Miller Act claim to the surety at the same time you deliver it to the prime contractor to ensure maximum attention (and quick attention) to your claim. If you don’t know who the bonding company is, you are authorized by the US Miller Act to ask for and receive information.

Step 3: Provide Backup and Sworn Claim Form To Surety

Once you know who the surety is, they should provide you a “Claim Form,” and they should request from you certain backup information about the claim which may include copies of your contract, your invoices, emails, communications, change orders, purchase orders, shipping confirmations, etc. The next step in the claims process is to get all of this information collated and sent back to the surety for it to review your claim, and to fill out and return their “sworn” claim form. These claim forms usually require you to have your signature notarized.

Put this information together as quickly as possible to return to the surety. Then, you likely have a 30-45 day waiting period for them to review your claim and make a decision.

Essential Reading: Don’t Surprise the Surety – Streamline Getting Paid On Bond Claims

Step 4: Get Paid Or Move Forward To Enforce Your Miller Act Claim

After your bond claim notice is sent and your bond claim backup information is returned, the surety should review the claim and get back to you within a reasonable time indicating that they will either pay the claim or reject the claim.

If the surety elects to pay the claim, they will require that you return a lien release and waiver in exchange for the payment. They may also request that you furnish them with a formal “Miller Act Claim Cancellation” to cancel the claim you previously made against the bond.

If the surety rejects the claim, your next step is to file a lawsuit to enforce the Miller Act Claim. These lawsuits must be filed in the federal district court where the project is located, and it must include the United States of America as a party! You will likely need a construction attorney to help you with this claim enforcement action.

The lawsuit to enforce your bond claim rights must be filed within 1 year from your last furnishing of labor or materials to the federal construction project.

How Do I Enforce a Miller Act Claim? 3 Questions You Have to Answer

So what happens if payment doesn’t come after a bond claim is made? A claimant may have to enforce their Miller Act claim. In order to enforce a Miller Act claim, the claimant will have to file a lawsuit.

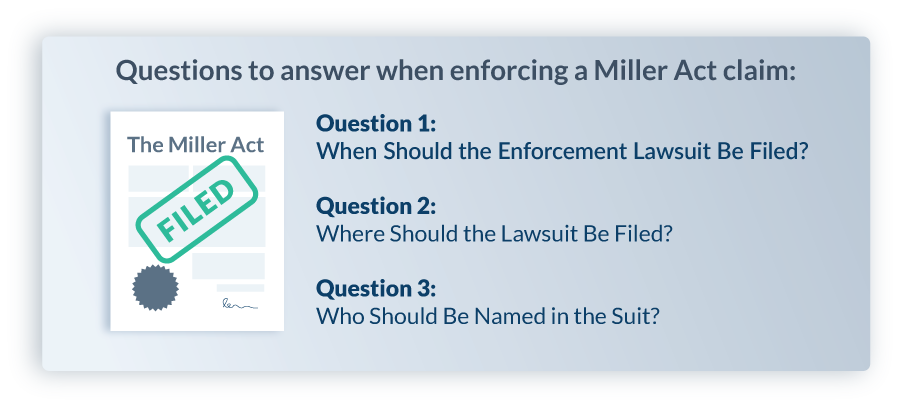

Here is a list of the important questions that must be addressed when enforcing a Miller Act Claim:

Q1: When Should the Enforcement Lawsuit Be Filed?

To make a Miller Act claim, a claimant has 90 days from the last furnishing of labor or materials to the project. But when should a suit be filed?

A suit to enforce a Miller Act claim should be filed after the 90 day period to make a claim. Other than that, there’s no clear cut answer when it should be filed. Every dispute is different. If progress towards resolving the dispute can be made without a lawsuit, handling the matter outside the courts will probably be the preferable option. However, a claimant only has a 1-year window to file suit, starting from the last date of furnishing labor and/or materials to the project. This allows a claimant to utilize some time to try and handle the matter between the parties involved. However, if it looks like there won’t be progress towards resolving the dispute – a claimant may want to file suit sooner than later.

Bottom line: when a claimant should file suit differs case by case. But all claimants must file suit within 1 year of the last furnishing – or else their right to sue will vanish.

Q2: Where Should the Lawsuit Be Filed?

The suit must be filed in the federal district court where the project is located. For the purposes of the Miller Act claim, it doesn’t matter where a claimant is located, where the prime contractor is from, or even where the surety calls home.

Q3: Who Should Be Named in the Suit?

This part can get tricky. When suing to enforce a Miller Act claim, a suit is brought against the bond. This means that the surety who provided the party will need to be named. The bond beneficiary (the party who secured the payment bond – typically the prime contractor) might also be named, but it’s not necessarily required.

Simple enough right? Well, a suit to enforce a Miller Act claim has an interesting caveat – the suit is brought in the name of the United States, on behalf of the party making the claim. Weird, right?

Last Thoughts on Enforcing a Miller Act Claim

At the end of the day, enforcing a Miller Act bond claim requires the initiation of a lawsuit – and a federal one at that. This means that hiring a lawyer will be necessary. A lawyer who has experience with Miller Act claims will be able to guide you through the process so a lot of these ins and outs might not be a huge issue. Remember that deadline, though! If the suit to enforce a Miller Act claim is not brought within 1 year of last furnishing, any other requirements and intricacies of making the claim will be irrelevant.

More Bond Claim Resources from Levelset

Make a Miller Act Claim with Levelset

The Payment Bond Claim Process (for non-federal, public projects)