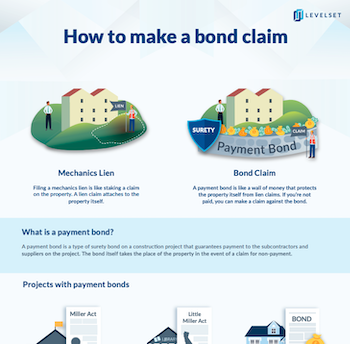

When the GC on a project has secured a payment bond from a surety, contractors and suppliers don’t typically have the option of filing a mechanics lien. So what can they do if they don’t get paid? In this article, we’ll look at what payment bonds are, how they work, and how to make a payment bond claim on a construction project.

What is a payment bond?

A payment bond is a type of surety bond on a construction project that guarantees payment to the subcontractors and suppliers on the project. The bond itself takes the place of the property in the event of a claim for non-payment.

On most private construction projects in the United States, a mechanics lien generally provides strong protection to contractors and material suppliers to ensure that they get paid for the work they do. If a contractor enforces a valid mechanics lien claim, they can force the sale of the property in order to get paid. However, on some projects, the property owner will require a payment bond in order to avoid putting the property itself at risk.

There are typically three parties involved in a payment bond: The bond surety, the principal, and the obligee. The surety is the company that provides the bond. The principal is the person or company that purchases the bond. The obligee is the party that is eligible to file a claim against the bond.

For a payment bond, the principal is typically the GC or prime contractor, and the obligee may be any party covered by the bond – subcontractor, material supplier, etc. – who doesn’t get paid.

Get the Illustrated Guide: How to make a payment bond claim

Download an infographic that explains what a payment bond is, the types of projects that use them, and how to make a claim if you're unpaid.

Download the infographicWhen are payment bonds used?

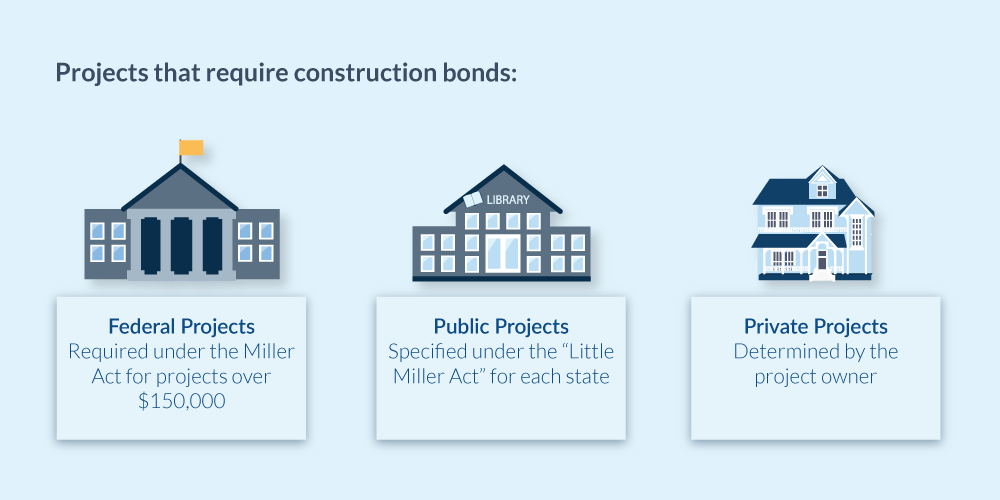

Payment bonds can be used on any construction project, but they are most common on government construction jobs, like public works projects. In a nutshell, a payment bond provides the same security on a public project that the property itself generally provides on a private project.

If subcontractors, suppliers, or other lower-tier parties are not paid on a project with a payment bond, the bond provides a type of security against which they can make their claim for payment.

The Miller Act: Federal projects

The Miller Act is a federal law requiring the prime contractor to secure a payment bond (as well as a performance bond) on government contracts exceeding $100,000.

State projects

Many states have adopted legislation based on the federal Miller Act. These are often called Little Miller Acts, though they vary state-by-state.

Payment bond requirements for state and municipal are set by each state individually. Some states or localities require that all public projects be bonded. Others may not specifically requiring bonds unless the initial contract is for more than $500,000.

However, as a practical matter, most substantial public works projects at any level require the prime contractor to obtain a payment bond.

Private projects

Some private property owners may also require the general contractor to purchase a payment bond, even when it’s not required by law. This requirement would typically be included in the construction contract.

Note however, that payment bonds aren’t required on private projects, but an owner or GC may provide a payment bond anyway. This provides an additional potential path to recover payment – even if a payment bond exists, a claimant may still file a mechanics lien to secure amounts due. Since private bonds are not regulated by statute, the requirements and timing provisions are set by the bond itself and the agreement between the surety and the obligee. Accordingly, it’s best to get a copy of the bond itself as soon as possible in order to understand the requirements for making a claim.

In some cases, a property owner or GC may also purchase a bond after a mechanics lien is filed; this is called “bonding off” a mechanics lien. They do this using a specific type of payment bond, sometimes called a mechanics lien bond or a mechanics lien release bond. Whereas a payment bond typically covers the value of an entire project, a mechanics lien bond generally covers the amount of the lien (plus a bit extra). The lien claim is then released from the property and “attached” to the bond.

Requesting a copy of the payment bond

If you’re working on a project with a payment bond, it’s generally a good idea to request a copy of the bond at the beginning of the job.

When payment problems arise on public construction projects, the payment bond becomes the center of the universe! It’s surprising how many project participants work on these projects without the payment bond in hand.

Well, guess what? You are entitled to a copy of the payment bond. No if’s, and’s, or but’s about this.

On construction projects in nearly every state and county, if the project is a public work, the state laws provide that you must be provided a copy of the payment bond upon request. You can usually request it from either the prime contractor or the public entity commissioning the work.

Why contractors & suppliers want a copy of the bond

There are two primary reasons why it’s important to have a copy of the payment bond:

- It identifies the bonding company

- It spells out the terms of the bond

First, knowing who the bonding company is can be critical to making a timely bond claim. In many states, you’re required to deliver your bond claim to the bonding company within a certain period of time. It’s obvious that you can’t send the claim to this party if you don’t know who they are.

If you wait to investigate the identity of a surety just before a bond claim deadline (when tempers may be shorter), you may find it harder to get – which, unfortunately, can impact your ability to make a claim.

Second, the payment bond discloses the terms of that bond. Payment bonds always have legal terms. Many potential bond claimants overlook this because there is so much focus on the state or federal rules governing the bond claim. Nevertheless, there are a handful of situations that can arise when your bond claim is compromised because of a failure to comply with the terms of the bond.

How to Get a Copy of the Payment Bond

Now that you know you’re entitled to a copy of the payment bond, you may be wondering, “How do I get a copy of the payment bond?”

Each state has slightly different procedures for requesting a copy of payment bonds, but in general, a formal written request is required from the party who is providing labor and/or materials to the applicable project.

These requests are typically sent to the prime contractor or the public entity commissioning the work, and they are sent by certified mail or certified mail with return receipt requested. In a minority of cases, the requesting party must actually provide a notarized affidavit affirming that they are furnishing to the project.

In states where preliminary notices are required on state construction projects, it’s a good practice to actually include this request within that notice. Whenever a preliminary notice is ordered from Levelset, we have that formal request for information built into the notice form. This ensures that the potential lien claimant gets a copy of the payment bond at the very start of construction.

Making a claim on a payment bond

The process of getting paid by a payment bond is similar to the process of filing a mechanics lien. This means bond claimants are subject to the same common mistakes that plague mechanics lien claimants.

Notice requirements

Many states require sending some sort of preliminary notice before a party is allowed to make a bond claim. As a result, it’s imperative that potential bond claimants track the notice requirements in the project’s state. Often, the preliminary notice requirements for bond claims are entirely different from the preliminary notice requirements for mechanics liens in the same state, so checking the state’s Little Miller Act statute is important.

After any required notices have been given, a party who remains unpaid may file a claim against the bond. This step is similar to making a mechanics claim in that there are specific deadline, form, and service requirements. It differs from a mechanics lien claim in that in almost all instances, there is no actual “filing” or “recording” of the document.

Who to notify

The parties required to receive the bond claim differ by state, but usually include at least the bonded prime contractor and generally the public entity, as well.

While generally not required, a small number of states do require parties to file a bond claim with the county recorder.

Finally, and also similarly to mechanics liens, a bond claim will expire after a certain amount of time passes. If the deadline to enforce passes, the claimant will no longer have a right of action against the bond to recover payment.

Video: How to Make a Payment Bond Claim

The Payment Bond Claim Process

Step 1: Send required notices to protect your bond claim rights

“Damn,” you’re probably thinking, “notices are required on state construction projects too??”

Not only are preliminary notices sometimes required on state and county construction projects, but they are frequently entirely different requirements from those on private projects in the same state (but not always). This is why we always recommend that subcontractors and suppliers get in the habit of sending preliminary notice on every job – whether it’s required or not.

As with private projects, it’s important to know and understand the notice requirements in your particular state. Send the notice that is required, maintain proof of sending or delivery, and do it at the very start of furnishing.

Step 2: Send a Notice of Intent

A Notice of Intent is like a demand letter. You send it after a payment was due, but before submitting a bond claim. A Notice of Intent is one final warning that if you don’t get paid on a job, then there will be consequences. (The “consequence” in this case is a bond claim.)

Typically, this optional notice is sent to the general contractor, but sometimes it must go to the surety or the public authority. Again, time frames will vary from state to state, so adhering to the requirements for a bond claim should be priority number one.

Even though a Notice of Intent is generally not a required document, our recommendation is to go ahead and send it anyway! Better to give the recipient one final warning – and one last opportunity to pay you – before you’re forced to proceed to the next step.

By sending such notice to the GC, the surety, and the awarding authority, all parties become aware that a payment dispute has occurred. Sending the notice of intent to everyone at the top of the payment chain will create pressure to settle the payment dispute.

Step 3: Submit your bond claim

If you remain unpaid even after sending the Notice of Intent, it may be time to lodge your bond claim. There are two issues to consider:

- The deadline to make a bond claim

- How to make the bond claim

Both of these vary from state to state, although there are a lot of consistencies in states that have adopted a standard “Little Miller Act.”

Making an official claim on the bond – sent to both the GC and the surety – should always be a step in the recovery process for public projects (plus, it’s usually required!).

Submitting a bond claim, at times, can be more complex than filing a lien claim. Typically, bond claims are “filed” by sending the claim via certified mail, return receipt requested to the required parties. The “required parties” that must receive the claim will vary by state, but it will be some combination of the GC, the surety, and the property owner/public authority.

Step 4: Send a Notice of Intent to Proceed Against Bond

After submitting your bond claim, you may choose to take an additional, though optional, step. A Notice of Intent to Proceed Against Bond is simply a letter that spells out exactly what you plan to do if you don’t get paid.

Contractors do not want claims against the bonds they post. Their bond history, including any claims made against it, will directly affect the cost of acquiring bonding moving forward. As a result, threatening to file suit against the bond just might light a fire under the GC’s rear-end which could result in payment.

If nothing else, a Notice of Intent to Proceed Against Bond will give the GC one last chance to pay up before taking to the courts. Since this is not a required document, it merely needs to be sent within the timeframe to file suit against the bond. It’s best practice to allow the contractor some time between sending this notice and filing a bond claim, but if deadlines are coming on quickly, don’t delay filing suit.

Step 5: Enforce your bond claim in court

Whether the claim was rejected, ignored, or the dispute is ongoing, filing suit against the bond is sometimes necessary for recovery. Typically, a suit against the bond must be filed within one year, but that’s not always the case. Again, it’s imperative to be aware of your state’s specific requirements.

Pay close attention to your deadline to file a court action against the bond. Even if a dispute is ongoing or feels like a resolution is right around the corner, be careful. A promise to pay isn’t the same as a payment itself. Your ability to file suit is among your strongest leverage during a negotiation.

See? Payment bonds aren’t so scary

For contractors that are new to working with a surety, navigating the payment bond process can seem daunting. However, there’s no need to panic. Surety bonds have been around in construction for a long time, and there are a lot of resources to help you figure it out.

Remember: If you work on a construction project anywhere in the United States, you have a right to get paid for it. Take some time to understand the process, learn your state’s rules and requirements, and protect your rights.

![The Payment [Surety] Bond Claim Process: Requirements and Mistakes to Avoid](https://www.levelset.com/wp-content/uploads/2019/07/bond-claim-mistakes-to-avoid.jpg)