Everyone in the construction industry encounters lien waiver documents, but too often, these complex and consequential forms are overlooked. Whether you’re a sole proprietor or a large corporation, understanding and managing construction lien waiver requests is important.

This comprehensive article will explain everything you need to know about lien waivers and walk you through best practices that could save your construction business from a very expensive mistake.

What Is a Lien Waiver?

A lien waiver is a document signed in exchange for payment that waives the signer’s right to file a lien for the amount specified in the waiver. You can think of lien waivers as the construction industry’s version of a receipt for payment.

Learn more: Lien Waiver Guide, Rules, and FAQs

On most projects, the GC requests, collects, and tracks lien waivers from everyone on the job when they are paid. This includes contractors, subcontractors, material suppliers, equipment rental companies, and any other party (potential lien claimant) to the construction project. Signing a waiver waives lien rights to the extent (the amount of money) set forth in the waiver.

Lien waiver example

Here’s an example of a construction lien waiver in action: A general contractor pays a subcontractor $100k and sends a waiver for the subcontractor to sign. The subcontractor then waives $100k worth of lien rights by signing the waiver. It’s as simple as that.

Lien waivers protect everybody. In the example above, the general contractor is protected from the threat of a mechanics lien, and the waiver protects the subcontractor from non-payment. When exchanging lien waivers works as intended, both parties to the lien waiver get what they earned, and the payment process is fair and transparent.

Need a Lien Waiver?

Create lien waivers in minutes for free. Send a signed waiver to your customer, or request a signature from vendors.

Why are lien waivers necessary?

Anyone furnishing materials, labor, or services to a construction project may be entitled to file a mechanics lien or bond claim in the event that they are not paid. But at the same time, those in charge or at “the top” of a project — such as the property owner, lender, construction manager, or general contractor — are highly motivated to finish the project successfully without any liens or bond claims being filed.

And that’s where waivers come in. Waivers serve as a sort of “proof of payment.” Every time a payment is made on a construction project, there is a payor (the paying party) and a payee (the party receiving payment). When lien waivers are involved, the payee will execute (sign) a lien waiver acknowledging receipt of the payment, and promising to not file a lien with respect to the same amount. They payor (typically, the GC) will collect and track all of the lien waivers from the subs and suppliers on the job, and submit them to the property owner.

When this system works as it should, everyone should walk away happy: The payee gets paid the money they’ve earned, and the paying party gets the assurance that there won’t be a mechanics lien filing. For these reasons, sending lien waivers can actually help you get paid faster.

Lien waivers serve as a sort of “proof of payment.” Every time a payment is made on a construction project, there is a payor (the paying party) and a payee (the party receiving payment). When lien waivers are involved, the payee will execute (sign) a lien waiver acknowledging receipt of the payment, and promising to not file a lien with respect to the same amount. They payor (typically, the GC) will collect and track all of the lien waivers from the subs and suppliers on the job, and submit them to the property owner.

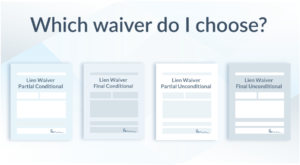

The 4 basic types of lien waivers

Lien waivers can either be conditional and unconditional. But because waivers act differently depending on whether it’s for a progress payment or a final payment, there are four main types of lien waivers:

- Partial conditional waiver

- Partial unconditional waiver

- Final conditional waiver

- Final unconditional

However, the majority of states do not regulate lien waivers at all (see below). In these states, the actual language used on lien waiver forms may be all over the place, and the lien waiver’s type may be unclear.

Nevertheless, regardless of how a lien waiver is labeled, it’s important to understand these waiver categories, and more importantly, which category applies to the lien waiver you’re being asked to sign.

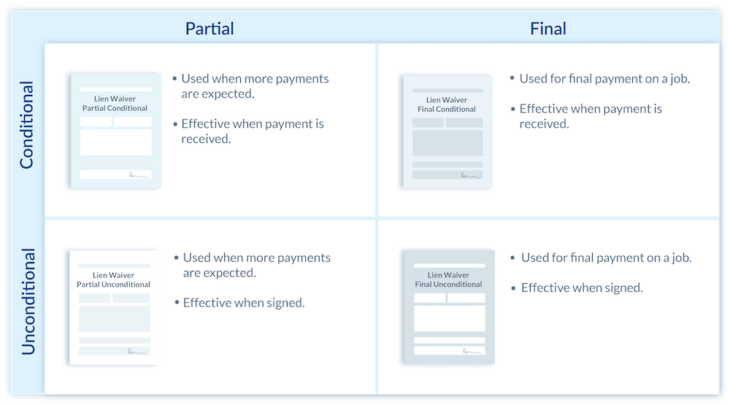

Conditional Lien Waivers

As the name suggests, conditional lien waivers waive lien rights on the condition of actual receipt of payment. There are two types of conditional waivers:

- Partial conditional waiver

- Final conditional waiver

Getting paid on a construction project creates a frustrating Catch-22 scenario. The paying party wants a lien waiver before making the payment, and the receiving party wants to receive the payment before handing over the lien waiver.

The solution to this standoff is to use the “conditional” set of waivers. These lien waivers are signed by the receiving party and promise to “waive” the lien rights upon receipt of payment. When payment is received, the condition is satisfied, and the lien waiver is effective.

Thus, everyone goes away happy (and paid!) and the Catch-22 situation is avoided.

1. Conditional Waiver for Progress or Partial Payment

A partial conditional waiver should be used when you are expecting to receive a progress payment on the project. You may be expecting future payments on the project, but are looking to sign a waiver for a specific progress or partial payment that you are receiving. Because this is a “conditional” waiver, you may not have received the payment. That is okay. A conditional lien waiver is “conditional” on your receipt of the payment and will be invalid if payment is not ultimately received. If you have already received this payment in full and have the money “in hand”, then you could consider signing an “unconditional” waiver (more on unconditional waivers below).

2. Conditional Waiver for Final Payment

A final conditional waiver should be on the contractor’s checklist for collecting final payment on the project. Signing a final waiver should only happen when you will not be expecting any future payments — i.e., for the last or final payment on a particular job. Because this is a “conditional” waiver, you may not have actually received the payment yet. That is okay. A Conditional lien waiver is “conditional” on your receipt of the payment and will be invalid if payment is not ultimately received. If you have already received payment in full and have the money “in hand”, then you could consider signing an “unconditional” waiver (more on unconditional waivers below).

Unconditional Lien Waivers

These next two categories of lien waivers are referred to as “Unconditional Waivers,” and they are much more dangerous to subcontractors and suppliers than their conditional cousins. Unlike conditional waivers, these unconditional lien waivers are completely effective and enforceable the instant they are signed, no matter if payment was actually received or not.

3. Unconditional Waiver for Progress or Partial Payment

An unconditional partial waiver should be used when you have received a progress payment on the project. You may be expecting future payments on the project, but are looking to sign a waiver for a specific progress or partial payment that you are receiving. Because this is an “unconditional” waiver, you must have actually received the payment and really have it, “in hand.” If you have not received the payment, if the check hasn’t yet cleared the bank, or if there is some other reason why payment might ultimately fail, this waiver should not be furnished. If this is the case, you may want to consider signing a “conditional” waiver since it is the safer choice.

4. Unconditional Waiver for Final Payment

A final unconditional waiver should be used when you have received final payment on the project. After signing this unconditional lien waiver, you will not be expecting any further payments in the future, and are confirming that you have received — in hand — all payments owed to you on the project. Because this is an “unconditional” waiver, you must have actually received the payment. If you have not received the payment, if the check hasn’t yet cleared the bank, or if there is some other reason why payment might ultimately fail, this waiver should not be furnished. If this is the case, you may want to consider signing a “conditional” waiver.

When to use each lien waiver type

Unconditional waivers are more dangerous to use than conditional waivers because unconditional waivers are effective immediately when signed, regardless of whether you actually received payment or not!

Your best, safest bet is to use conditional waivers whenever possible. Not only will you resolve the Catch-22 situation described above, but you’ll also be sure to only waive your lien rights after you actually receive payment.

The Difference Between Lien Waivers and Lien Releases

Here’s a big problem about lien waivers — the waiver terminology used is not standardized across the construction industry. Depending on where you work or whom you work with, you may hear folks calling lien waivers by another name, such as “lien release” or “waiver of lien” and many others. California’s lien waiver laws actually refer to it as a “Waiver and Release.”

This can get confusing, especially since a lien release is an entirely different document from a lien waiver. While a lien waiver is used to prevent mechanics liens, a lien release is used to cancel a lien after it has been filed. (It’s also known as a lien cancellation.)

Not surprisingly, the terminology used by the industry to describe a lien cancellation is also very haphazard. You might also hear “lien removal” or “lien release” and several others. All in all, this problem with confusing terminology can have serious consequences, so be clear about which document you’re referring to!

Lien Waivers vs. “No Lien Clauses”

Unfortunately, the naming confusion does not end there. Another confusing concept in the world of construction payment is “no lien clauses.”

No lien clauses (also called “no lien agreements”) are provisions in a construction agreement whereby a party agrees to waive any future lien claims. Since the contract is typically signed at the very beginning of a project before the work actually begins, this means that a “no lien clause” comes into play before any payment is due and/or before any furnishing.

Read more: Why waiving your lien rights before a project is a bad idea

A no lien clause is different from a lien waiver. A waiver comes after the work has been performed and is only signed by parties after a payment is due, wherein the party waives the right to file a lien for the work that is being paid for.

Unlike the lien waiver document, no lien clauses are very controversial. In fact, they are only formally allowed in just 2 states. No lien clauses are expressly outlawed by the legislatures in over 20 states.

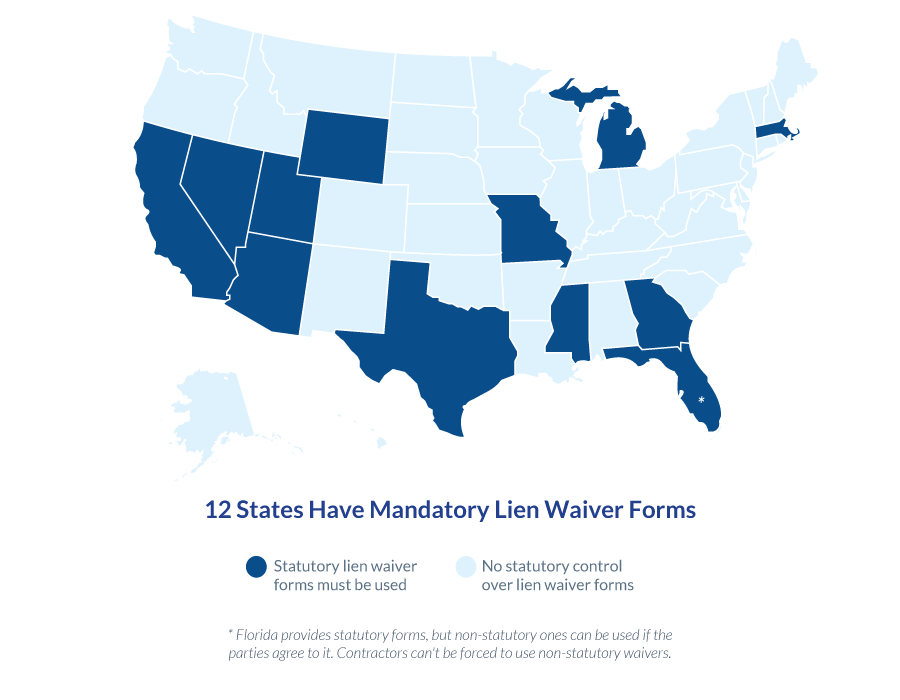

12 States With Required Lien Waiver Forms

Now that you know some lien waiver background information, it’s time to turn to the instrument itself. This where lien waiver management gets enormously confusing. While a few states create mandatory lien waiver forms, the majority of states do not, which leaves the parties to grapple about what these documents should and should not say.

Only 12 states have statutory requirements for lien waiver forms, which are highlighted on this color-coded map, below.

*Florida does not require that parties use the statutory lien waiver, but it offers the waiver as a safe option, and seems to prohibit parties from requiring a non-statutory form.

If you are furnishing materials, labor or services to one of the 12 “regulated” states, dealing with lien waivers is a little easier. If the time is right to sign a lien waiver, you simply serve up the statutory form and submit it. There is no room for debate about the contents of the lien waiver document because the state legislatures typically render any non-statutory lien waiver forms as completely null and void.

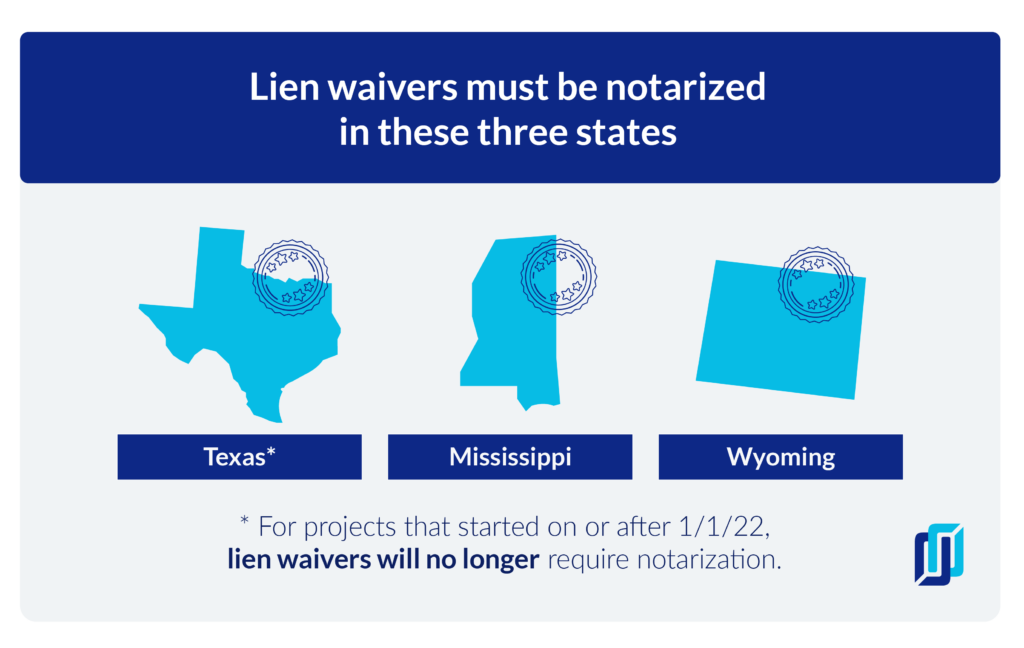

3 States Require Notarization on Lien Waivers

There are 3 states where lien waivers must be notarized:

- Texas*

- Note: For projects entered into on or after 1/1/22, lien waivers will no longer require notarization.

- Wyoming

- Mississippi

If working on a construction project in one of these three states, then notarization in order for a lien waiver to be considered valid and enforceable.

Additionally, it’s important to note that notarization in other states could negatively impact the lien waiver’s validity. If working in one of the 12 states that provide statutory lien waivers, the statutes typically state that the lien waiver must be “in substantially the same form” as the one provided. Courts in those states tend to enforce this requirement rather strictly.

Meaning that any alterations, including notarization, could materially change the form, thereby invalidating it.

Texas rules for mechanics liens and notices are subject to major changes in 2022.

The information on this page has already been updated to reflect the new rules.

Dangerous Language to Watch for in a Waiver

Because 38 states do not have statutory requirements for lien waiver forms, they allow the forms to appear in basically whatever form the parties want. This can create confusion and allow lien waivers to be used as a document to craft a legal position. While this isn’t the intended purpose of lien waivers, it is something that a vigilant party should be on the lookout for.

Below are 3 examples of potentially troublesome waiver language that you need to be wary of.

Retainage, Change Orders, Extra Work

Managing lien waivers on projects where there is retainage, change orders, and “extra work” can be a huge challenge.

“Retainage creates a tricky issue” in lien waivers, explains David Eisenberg. “Because the lien waiver is supposed to waive lien rights to all work performed up to the effective date…[if] an owner is withholding retainage, contractors risk waiving their lien rights if they submit unconditional lien waivers.”

This is yet another reason why unconditional waivers are dangerous to use!

The same “tricky issue” is present with a few other token construction contract issues like unapproved or pending change orders and extra work.

Subcontractors are typically required to submit their pay requests through a pay application, and that pay application includes certain work items and excludes certain work items. The trouble with many lien waivers is the language frequently waives “everything” up to a certain date, irrespective of what may be excluded by the pay application (i.e. retainage, pending change orders, etc.).

Subcontractors must be very, very careful with this.

California’s statutory lien waiver forms handle this issue fairly well. Each of its waivers contains a section labeled “Exceptions,” where the subcontractor can stash any number of excepted items, and the progress waivers include statutory exception text excluding retainage and unpaid “extra” work. It’s still important that subcontractors keep their head up, notice this exceptions section, and accurately complete it.

Further reading:

Waiving Contractual Rights

Starting up on a new construction job includes many activities. There’s the RFP, the estimating process, submitting your bid, and so on. If your company is chosen to work on the job, at some point before the work commences, you’ll probably sign a contract. That contract will spell out all of your agreed-upon responsibilities (what you have to do), and also, all of your agreed-upon “rights” as spelled out in the contract (what you get).

Regarding lien waivers, the danger here is that your construction contract says you’re allowed a certain right, but then you sign a lien waiver that includes language stating that you a “waiving” or giving up that right.

There’s an infamous case out of Texas involving a company called Zachry Construction that illustrates the danger here. In that case, Zachry ended up losing over $2 million because the waivers they signed prohibited them from defending themselves against liquidated damages.

Take a moment to think about how scary this scenario can be:

Zachry Construction did work and was owed money for it. To receive a payment, they were required to sign lien waivers. The exchange of lien waiver for payment is completely fair, and a sensible and traditional thing for both parties to do. However, the parties also had some things they disputed aside from the exchanged payment (i.e. liquidated damages). The lien waiver document, which really has nothing to do with the dispute, disarmed Zachry completely because it had provisions within it waiving the rights to assert any defenses.

Unfortunately for Zachry, the lien waivers they signed included provisions that waived a lot more than lien rights, and it ended up costing them millions of dollars.

Bottom line: Be careful that the waivers you’re signing in order to get paid do not include any extra language that causes you to give up contractual rights!

Personal Attestations: Using a Waiver to Create Personal Liability

Another thing we’ve seen in lien waivers is a requirement that the person signing the waiver “personally attest” to the contents of the waiver. This personal attestation requirement may seem benign at first glance, but in reality, it creates potential personal liability on a construction contract that likely does not have any personal liability otherwise.

Obviously, a subcontractor or an employee at the subcontractor’s office will want to avoid this risk.

Learn about when to sign a waiver:

Why the Lien Waiver Amount Matters

Let’s say you were paid $50,000, but your lien waiver says you were paid $100,000.

There are two possible explanations for this. Perhaps, first, you made a mistake and the waiver amount is simply an accident. Or perhaps, second, the lien waiver amount was requested by the owner and general with the promise to pay you the full amount later.

The trouble with lien waivers is that the law probably doesn’t care about these explanations at all. In most states, the courts will look to the waiver itself, and if it says $100,000, that’s the final authority on the matter. You were legally just paid the $100,000.

State legislatures and courts are constantly balancing the rights of owners against the rights of potential lien claimants, and the whole point of the lien waiver is to protect third parties against unknown liens. If the third party does their job of collecting the lien waivers, then the courts and statutes must protect them in the event the waivers are inaccurate through no fault of their own. In large part, that is exactly what happens.

Bottom line: When you sign a lien waiver, therefore, what the waiver says you received is always more important than what you actually received.

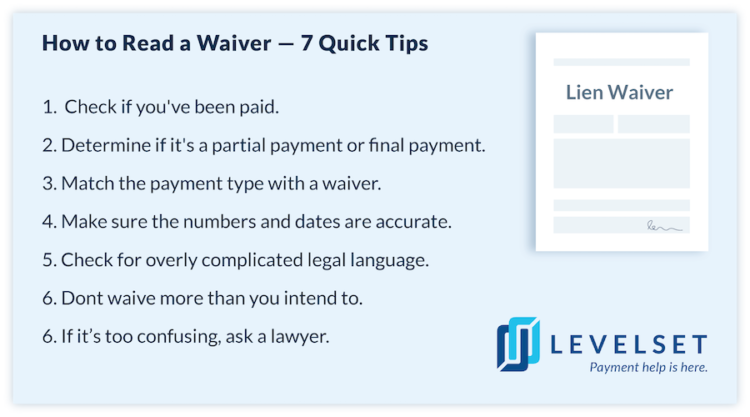

How to Read a Waiver: Quick Takeaways

- Before you start, know if you’ve been paid and the nature of the payment (progress/partial or final)

- Match the nature of the payment to the appropriate lien waiver type (look for a specific language)

- Look at the length of the document and at the clarity of the language

- Make sure it’s accurate since what’s included in the waiver itself is more important than what actually transpired

- If the document is long and/or confusing keep a sharp eye out for language that waives more than what you intend

- If it’s too confusing, ask a lawyer

Essential Reading:

Lien Waiver Policies and Procedures – Best Practices

It should now be clear that lien waiver documents are complicated and largely unregulated, and that their consequences could be severe. It’s surprising, therefore, how infrequently companies employ formal policies controlling how lien waivers are processed and managed. Too often, companies simply enable their staff to exchange lien waivers for payments willy-nilly, blind to the hidden dangers that may be lurking in the details of a lien waiver form.

Just like your company relies on policies and procedures to dictate who can receive trade credit, and how debts can be collected, and even how liens and bond claims must be managed, so too should your company rely on a written policy and procedure to manage how lien waiver requests are received and handled.

Here are the three things that you must achieve with your lien waiver policy:

Regulate the Form To Keep Things Consistent

Identify the states where statutory forms are used and provide a place for those forms to be referenced. For all other states, establish an accepted, standardized form that can be used for lien waivers. This enables you to save time with a default waiver template.

Create a Handling Process

When are lien waivers provided/requested? Who is authorized to review waivers that differ from the default template? Who is authorized to approve them? How are those processes managed?

A road map is required to give every lien waiver request consistent treatment.

Automate the Waiver Process and Make It Electronic

The quick and easy exchange and management of documents is the biggest obstacle to changing waivers from vehicles of fear and friction to the documents that free projects from those concerns. Using lien waiver software can help make the lien waiver exchange process easier and simpler for everyone.

The ability of construction participants to a) “automatically” (whether by a manual process or true automation) send sufficient and appropriate lien waivers prior to request, and b) have a system to receive and manage the documents received takes the frustration out of the process and leads to good results.

This is impossible to do without the use of proper tools, though. The ability to request lien waivers, to accept lien waivers in any form (but primarily electronically), and have all waivers available in one place to be viewed and managed is a life-changer. And the ability to send waivers without worry regarding the waiver form or template or fear over whether additional rights are being waived or additional obligations imposed is crucial.

Interested in using some tools to help your lien waiver process but not sure of which one? Take a look at our guide to the Best Lien Waiver Software Apps, including ratings & reviews.

Free Lien Waiver Form Downloads for All 50 States

Use the following links to download the lien waiver forms you need.

- Alabama Waiver of Lien FAQ & Form

- Alaska Waiver of Lien FAQ & Form

- Arizona Waiver of Lien FAQ & Form

- Arkansas Waiver of Lien FAQ & Form

- California Waiver of Lien FAQ &Form

- Colorado Waiver of Lien FAQ & Form

- Connecticut Waiver of Lien FAQ & Form

- Delaware Waiver of Lien FAQ & Form

- Florida Waiver of Lien FAQ & Form

- Georgia Waiver of Lien FAQ & Form

- Hawaii Waiver of Lien FAQ & Form

- Idaho Waiver of Lien FAQ & Form

- Illinois Waiver of Lien FAQ & Form

- Indiana Waiver of Lien FAQ & Form

- Iowa Waiver of Lien FAQ & Form

- Kansas Waiver of Lien FAQ & Form

- Kentucky Waiver of Lien FAQ & Form

- Louisiana Waiver of Lien FAQ & Form

- Maine Waiver of Lien FAQ & Form

- Maryland Waiver of Lien FAQ & Form

- Massachusetts Waiver of Lien FAQ & Form

- Michigan Waiver of Lien FAQ & Form

- Minnesota Waiver of Lien FAQ & Form

- Mississippi Waiver of Lien FAQ & Form

- Missouri Waiver of Lien FAQ & Form

- Montana Waiver of Lien FAQ & Form

- Nevada Waiver of Lien FAQ & Form

- Nebraska Waiver of Lien FAQ & Form

- N. Hampshire Waiver of Lien FAQ & Form

- New Jersey Waiver of Lien FAQ & Form

- New Mexico Waiver of Lien FAQ & Form

- New York Waiver of Lien FAQ & Form

- N. Carolina Waiver of Lien FAQ & Form

- N. Dakota Waiver of Lien FAQ & Form

- Ohio Waiver of Lien FAQ & Form

- Oklahoma Waiver of Lien FAQ & Form

- Oregon Waiver of Lien FAQ & Form

- Pennsylvania Waiver of Lien FAQ & Form

- Rhode Island Waiver of Lien FAQ & Form

- S. Carolina Waiver of Lien FAQ & Form

- S. Dakota Waiver of Lien FAQ & Form

- Tennessee Waiver of Lien FAQ & Form

- Texas Waiver of Lien FAQ & Form

- Utah Waiver of Lien FAQ & Form

- Vermont Waiver of Lien FAQ & Form

- Virginia Waiver of Lien FAQ & Form

- Washington Waiver of Lien FAQ & Form

- Wash DC Waiver of Lien FAQ & Form

- W. Virginia Waiver of Lien FAQ & Form

- Wisconsin Waiver of Lien FAQ & Form

- Wyoming Waiver of Lien FAQ & Form