To put it simply, a joint check is a check made payable to two or more parties. A joint check agreement is a contractual agreement whereby one party agrees to (or gives permission to) make payment in the form of joint checks.

An example of a joint check agreement from the construction industry would be where the prime or general contractor agrees to issue a check jointly to the first-tier subcontractor and that sub’s material supplier.

Joint checks agreements can be used in any industry. However, these tools are utilized far more in construction than anywhere else.

How Basic Joint Check Agreements Work

Joint check agreements are most common in the construction industry because so many tiers of parties participate on a typical construction project. This reality of the construction business just happens to perfectly fit with the joint check concept.

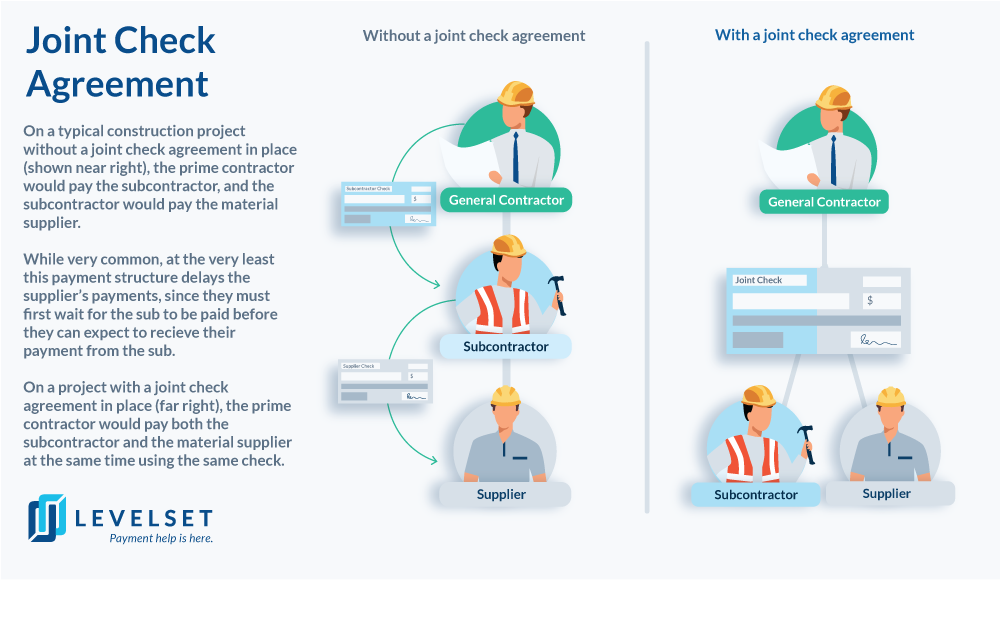

A joint check agreement is commonly entered into between a general contractor, a subcontractor and a material supplier. The supplier, being hired by the subcontractor, wants to protect itself against non-payment. All three parties agree that any payments made by the general contractor for work involving the supplier’s materials will be written jointly to the subcontractor and the material supplier.

With a joint check agreement in place, the material supplier is protected against the risk of the subcontractor not paying them, even after the sub received payment from the GC. The general contractor is protected from the risk of the supplier not getting paid and filing a mechanics lien.

Infographic: Joint Check Agreements

Without a joint check agreement in place, when work is completed, the prime contractor will pay the subcontractor for the work. The subcontractor will turn around and pay the supplier for the building material supplies that were involved in the work. Ideally, all parties get paid, but of course, there are inefficiencies and risks that interrupt the proper trickling down of construction payments.

All Three Parties to a Joint Check Agreement Must Sign the Agreement

All of this confusing contract law babble means just one thing: get everyone to sign the joint check agreement.

If every one of the three parties to a joint check agreement doesn’t sign the agreement it could come under attack. The only party who could possibly be forgiven for not signing the agreement is the lowest tier who is receiving the benefit of the agreement (i.e. the original contract’s obligor), and that’s because many state’s case law suggests that the party receiving the benefit of an obligation need not sign the agreement to claim the benefit. Nevertheless, why roll the dice on this? If you’re benefiting from a joint check agreement you might as well sign it, too.

Joint Check Agreements Exist by Contract and Not by Statute (Law)

Where does this “joint check” concept come from? Is there a federal or state statute to give contractors, owners, and suppliers a guideline on how these agreements work? Are there some regulatory restrictions on what can be agreed upon within a joint check agreement?

Joint check agreements is not a creature of statute. In other words, there is no state or federal law that governs joint check agreements specifically or offers any guidelines.

To the contrary, joint check agreements are a creature of contract. In the United States, all parties have the general freedom to contract for whatever they want. The law only marginally restricts this freedom to prohibit folks from violating public policy (i.e. contracting into slavery, murder…or “no lien clauses”).

What does this mean?

It means that there is no such thing as a “standard joint check agreement.”

Accordingly, the parties to a joint check agreement can write the agreement any way they want. While this sounds nice and flexible, the result is that the industry is flooded with a ton of sample joint check agreements, and each of the samples would have sometimes significantly different effect.

Beware of the Joint Check Rule

The “joint check rule” means that whenever an owner or a general contractor issues a joint check to a subcontractor and the subcontractor’s material supplier, the material supplier endorsing and depositing the joint check is certifying that it has been paid all amounts due up to the date of the joint check.

Be very careful about this!

Consider this scenario. You’re owed $100,000 for materials furnished to a subcontractor over two months ago. The account has been flagged as high risk, all furnishing has been put on hold and you’ve started to prepare a collection plan that may involve filing a bond claim or mechanics lien. The general contractor sends you a check for $85,000 jointly written to you and the subcontractor. You could really use this money.

Should you deposit the $85,000 and then proceed for the remainder separately? Can you really reject acceptance of this huge chunk of cash?

According to the joint check rule, if you endorse and/or deposit that $85,000 check, you’ll be waiving your rights to the remaining $15,000 debt. Period. End of story. You’ll be unable to sue for the unpaid portion, and any lien or bond claims you file will be considered invalid.

A Common Joint Check Mistake – Obligatory vs. Permissive Terms

Since there is no such thing as a standard joint check agreement, these agreements are subject to the contractual will of the parties. As a result, there are differences from agreement to agreement. One huge difference between agreements is that some obligate the paying party to issue a joint check, and others merely give permission to do so.

If you think your joint check agreement obligates the paying party to pay you, when in actuality it only gives the paying party permission, you may have a very difficult time getting paid if the paying party winds up not issuing a joint check.

From the paying party’s perspective on the other hand, the misunderstanding that that permission is required only when an actual obligation exists can create a similar bad situation.

Paying Parties Typically Don’t Want to Incur a Joint Check Obligation

Joint check agreements primarily benefit the lowest tiered party (like a building material supplier). The party making the initial payment – usually the general contractor or property owner – do receive a slight benefit from these agreements, but the benefit pales in comparison to the benefit afforded the party getting the payment.

General contractors or developers typically do not want to incur an additional obligation through a joint check agreement.

Accordingly, the motivation for the general contractor or developer in signing a joint check is usually pretty low. It is for this reason that these parties typically do not want to incur an additional obligation through a joint check agreement.

If they sign an agreement with a lower tiered sub or supplier and obligate themselves to issue a joint check for any work involving that lower tier, that creates a pretty inconvenient obligation. There are a few reasons why a paying party would want to avoid such an obligation:

- Keeping track of which lower tiered parties have joint check agreements and which don’t is difficult, and prone to mistake;

- Having to dissect each payment into its component parts to make sure each lower tier gets paid in the correct proportion is an added and unnecessary administrative task;

- Any mistake made leaves the paying party subject to an obligation it normally would not have.

Paying Parties Do Like the Power of Permission to Issues a Joint Check

While paying parties want to avoid incurring a new obligation with a lower tiered subcontractor or supplier, they do like the power that comes with permission to issue a joint check.

Absent a joint check agreement, a general contractor or developer cannot usually issue a check to a lower tier. Instead, they must follow the standard payment pattern (paying their contractor and trusting the contractor will pay people down the line). Entering into a joint check agreement whereby their customer gives permission to pay lower tiers on a joint check gives the general paying party some additional power to control the payment flow.

While they may not need to do this often, if circumstances warrant it, then it’s a good risk control tool.

Look to the Terms of You Specific Agreement to See if it’s Obligatory or Permissive

What dictates whether the paying party must or merely may issue joint checks? The joint check agreement, of course.

Since there are no “standard” joint check agreements, you’ll need to review the language within the specific joint check agreement at play to see which rules apply to your situation. Yes, we know how boring and complex that is.

Why You May Need to Enforce a Joint Check Agreement

Let’s start with some reasons why you may put into a position where a joint check agreement may need to be enforced. Here are some common scenarios:

Joint Payee Refuses to Sign the Check

Joint checks are just that: a check instrument written to your company and somebody else. When everything is going smoothly on a project there usually aren’t any problems. These checks come in, they’re signed by the parties and deposited by one party according to an agreement. For a variety of reasons, however, a project may reach a point when the parties stop cooperating with one another or when one party feels entitled to remedies or payments that are in dispute. These situations are challenging when joint checks are in play since one party will likely refuse to sign.

Owner or Contractor Doesn’t Include You on the Check

Another situation may arise when the paying party issues the check without your company on it in violation of a joint check agreement. This can happen accidentally or intentionally. Nevertheless, it is a violation of the joint check agreement, and if the parties do not cooperate to correct the issue, the paying party may be reluctant to issue another check to you and pay for the work or materials twice.

How to Enforce Your Joint Check Agreement

Writing a how-to on enforcing a joint check agreement is a tricky subject since these agreements are a creature of contract and vary greatly from one agreement to the next. Accordingly, what may be appropriate for one agreement may not be appropriate for another. It’s advisable, therefore, that you consult with a construction attorney as your first step here.

STEP 1: REVIEW YOUR JOINT CHECK AGREEMENT AND FOLLOW PROCEDURES

The first thing you’ll want to do is review your joint check agreement’s terms. Make sure that a violation actually occurred (duh!), but then also review the terms to see if there are defined procedures on enforcing your agreements.

Sometimes a contract will have very strict enforcement terms requiring formal notices, mediation, arbitration, cure periods or enforcement delay. Making a misstep with these procedures will not only cost you precious time and money, but it may cost you your entire claim. It is not unheard of for entire valid claims to get dismissed because parties did not follow their notice or enforcement procedures.

STEP 2: CONSIDER YOUR BIG PICTURE ARGUMENT

Enforcing a joint check agreement may be the whole dispute. A lot of the time, however, it is only a tiny part of the arguments between the parties. It is because of a bunch of other arguments that the joint check issue even arises.

It is possible to go after the parties with a narrow focus on the joint check agreement’s obligations. Unfortunately, however, every other argument under the sun is likely to get roped in (workmanship disputes, delay, damages, contract violations, etc.). When looking to enforce your joint check agreement don’t be naive about these other disputes. Keep them all in mind and come up with your big picture legal plan.

Joint Check Fraud – What to Look Out For

Forged Signatures on Joint Check Agreements

Subcontractors are under pressure to get materials to perform their scope of work on time and within budget. If a material supplier refuses to extend enough credit to get the job done, it could lead the subcontractor into a desperate situation. The solution to their problem may be a joint check agreement. But what if the general contractor refuses to agree?

Subcontractors and others with credit problems have been known to forge a general contractor’s or developer’s signature on a joint check agreement. You should understand that this occurs in the industry, and it is a good practice to send an email or make a phone call to the general contractor or developer to confirm that they did indeed sign the joint check agreement and understand their obligations.

Forged Endorsements on Joint Checks

Forging signatures on joint check agreements is less common than this more troubling joint check fraudulent act: forging a check endorsement.

Subcontractors in need of cash may get their hands on a joint check and forge the other party’s signature on it to deposit it on their own. They may have good intentions to pay you but may come up short because of cash flow issues.

If this happens, you should contact the maker of the check (the general contractor/ developer) and have them file a fraud report with their bank. If this is done soon enough, it’s possible that the bank will be capable of reversing the deposit. You may also have a civil action against the company forging your signature for fraud.

Joint Check Agreement – Free Form Template Download

Click on the button below to download a free joint check template that you can use on your projects and jobs.