Lien waivers are often the last document standing in the way of payment on a construction project. There is a lot of pressure and motivation to get the document signed and out of the way. There is a lot of pressure to make compromises, too.

You have the lien waiver document on your desk staring right up at you. The project manager wants it signed ASAP. The owner wants it signed ASAP. And even you want it signed ASAP!

But should you sign it? Are the terms fair? Will this come back to haunt you on the project? Will you wind up with egg on your face?

Lien waiver exchanges are commonplace during a construction job. But, it cannot be forgotten that lien waivers are legal documents. When you sign a lien waiver your company’s legal rights are implicated — including, but not limited to, your right to file a mechanics lien. And as we’ll see in this article, some waivers are worse than others.

You’ve got a lien waiver on the line. Everyone wants you to sign it. This article will help you decide whether you should.

Your Lien Waiver Signing Checklist

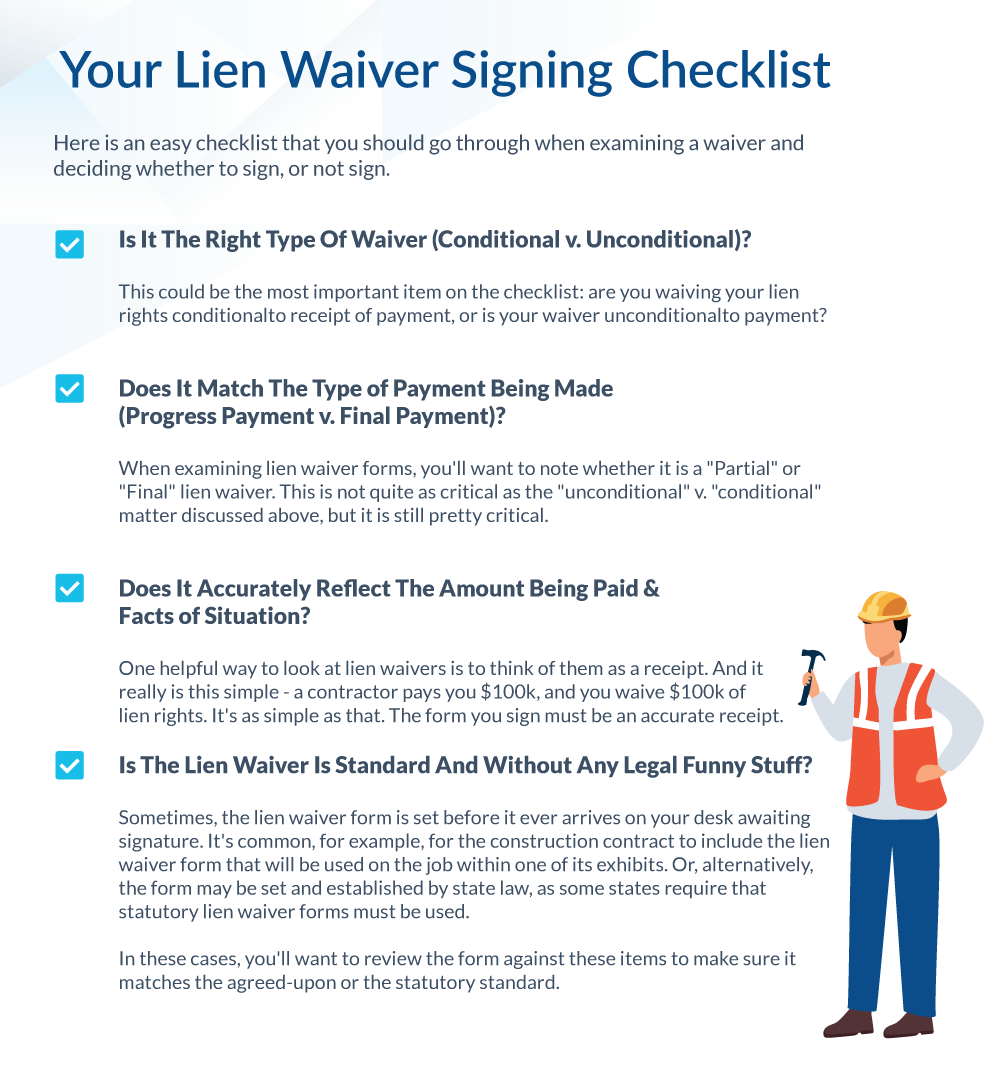

Generally speaking, you should sign the lien waiver presented to you. In a majority of cases, the lien waiver itself is unexceptional, and the best course of action is to get the waiver signed to clear the way for payment. With that said, there are a lot of waiver horror stories out there, and the complexity of these documents can lead to many things going wrong. Here is an easy checklist that you should go through when examining a waiver and deciding whether to sign, or not sign.

The short answer to that question is YES, but only when they’re signing the correct lien waiver at the correct time. And when it comes to whether or not you should sign a lien waiver, those two details make all the difference in the world.

1. Is It The Right Type Of Waiver (Conditional v. Unconditional)?

This could be the most important item on the checklist: are you waiving your lien rights conditional to receipt of payment, or is your waiver unconditional to payment? This is such an important and complex issue that we have a blog post dedicated to the topic: Unconditional Lien Waivers v. Conditional Lien Waivers.

And while we talk about it pretty clearly in this article, the truth is that you may not be able to quickly figure out whether your waiver is conditional or unconditional. These things aren’t always clearly labeled on the waiver itself. There’s an expert answer about this in the Expert Center: How do I tell the difference between a conditional and unconditional lien waiver?

Use Caution with Unconditional Lien Waivers

Unconditional lien waivers go into effect the moment they are signed. This means that the moment you put ink on the page, you’re waiving your lien rights. Period. Unconditionally. Regardless of whether you were paid or not. And, in some cases, even if you signed at the time of receiving a check and the check bounces. The promise of payment, in other words, doesn’t equal payment for unconditional waivers.

Look at some examples the unconditional lien waivers gone wrong in cases we wrote about in Arizona, Nevada, and Texas.

Some states have a safety net for contractors who sign unconditional lien waivers before actually receiving payment. In these states (look at a map of states here), such a waiver will be invalidated. Further, some states go so far as to make it illegal for anyone to even ask for an unconditional lien waiver before payment is actually made. However, the rules in these states are not always straightforward, and you want to avoid using this safety net if possible.

It is best practice not to sign an unconditional waiver until payment has actually been received.

Use Conditional Waivers Whenever Possible (And Possibly, All The Time!)

Conditional waivers aren’t effective until the “condition” has been met – so they can be provided at basically anytime with no worry. It is not a bad idea to consider sending a conditional waiver with every invoice or pay app to promote faster payment by making the process smoother and more straightforward for the party making payment.

Conclusion – The Checklist Items

You want to be careful about signing unconditional lien waivers, and you can be more liberal about signing conditional lien waivers. Whenever someone is asking you to sign an unconditional waiver, and you haven’t been paid, the warning bells should go off in your head. In this case…then stop. Don’t sign it.

√ The waiver is “conditional” upon payment

√ The waiver is “unconditional,” but you are certain that you’ve been paid for this work

X The waiver is “unconditional.”

2. Does It Match The Type of Payment Being Made (Progress Payment v. Final Payment)?

When examining lien waiver forms, you’ll want to note whether it is a “Partial” or “Final” lien waiver. This is not quite as critical as the “unconditional” v. “conditional” matter discussed above, but it is still pretty critical. This is important because partial lien waivers restrict the legal agreement about waiving lien rights to a certain window of time…whereas final lien waivers very broadly waive lien rights for anything you could still be owed on the entire project.

Simply defined:

- Partial lien waivers (also called progress waivers) waive lien rights for work done for the identified pay period. You can tell that a lien waiver is a “Partial” or “Progress” waiver because it will have a “through date” within it, and will say something along the lines of “waives lien rights for all work done through –/–/—-.” If you are not being paid 100% of the amount that you’ll ever collect on the job, then you want to sign a progress waiver.

- Final lien waivers (also called final waivers or final releases) waive lien rights for all work and materials on the job. These documents will not have a “through date” on them because there is no need to limit the waiver. The waiver applies to all the work and materials supplied on the job. You will want to sign a waiver like this whenever the payment is for 100% of what you are owed and will ever be owed for the project.

You want to be careful about signing both final and progress lien waivers because in both cases, the details within them need to be accurate. If you’re expecting more money from this project at any time and are being asked to sign a final lien waiver…then stop. Don’t sign it.

√ The waiver is “partial,” and you plan on receiving more payments in the future

√ The waiver is “final,” and you don’t plan on receiving more payments in the future

X The waiver is “final,” and you plan on receiving more payments in the future

3. Does It Accurately Reflect The Amount Being Paid & Facts of Situation?

When you’re reviewing a lien waiver, compare the waiver language it to the facts of your situation. For good measure, you may even want to ask yourself these questions:

- Is the dollar amount identified, right?

- Is the date of services correct?

- Is the scope of work correct?

- Are you waiving rights on any amounts not yet paid?

One helpful way to look at lien waivers is to think of them as a receipt. And it really is this simple – a contractor pays you $100k, and you waive $100k of lien rights. It’s as simple as that. The form you sign must be an accurate receipt.

One common practice in some jurisdictions (like Florida) is to sign $10 or $0 lien waivers. This is a hack to speed up the process. And it’s not a very good idea. See the discussion of this on our Expert Center here: Are $0 lien waivers valid?

You wouldn’t pay $2,500 for car repairs that only cost $1,500. If the dealership gave you a receipt to this effect, you’d notice the problem, point it out and fix it. The only difference between this and the situation with lien waivers is that lien waivers are typically wordier than a receipt, and therefore, you’ll probably have to spend some time reading the waiver document to make sure you’re understanding it.

You want to be careful about the details within your lien waiver. This has nothing to do with legal terminology. This is simple facts stuff. What does the waiver say? Is it true? If not…then stop. Don’t sign it.

√ The waiver identifies the exact amount you’re being paid

√ The waiver identifies the correct project

√ The waiver form identifies the correct period of time covered by the lien waiver

X The waiver identifies an amount that is not the same that you’re being paid

X Waiver identifies the wrong project

X Waiver identifies the incorrect period of time covered by the waiver

4. Is The Lien Waiver Is Standard And Without Any Legal Funny Stuff?

Sometimes, the lien waiver form is set before it ever arrives on your desk awaiting signature. It’s common, for example, for the construction contract to include the lien waiver form that will be used on the job within one of its exhibits. Or, alternatively, the form may be set and established by state law, as some states require that statutory lien waiver forms must be used (see “The 12 States With Statutory Forms“).

In these cases, you’ll want to review the form against these items to make sure it matches the agreed-upon or the statutory standard. In other cases, though, this might be the first time you’ve seen the form. If that’s so, you’ll want to closely examine the lien waiver to make sure there isn’t any legal funny stuff within. As we’ll explore below in the section about unfair lien waivers, it’s way too common for aggressive owners, general contractors, and others, to include over-the-top legal protections within waivers, effectively turning it into a massive legal release or indemnification agreement.

You want to be careful about this…and if the waiver is trying to do anything more than simply waiving lien rights associated with the payment being made…then stop. Don’t sign it.

√ The waiver uses state established form

√ The waiver form matches form agreed upon in the contract

√ The waiver form simply waives lien rights associated with the exact payment being made

X Waiver seeks indemnification

X Waiver includes legal protections and agreements

X Waiver does not use form required by the state

X Waiver is different than the form set out in the contract

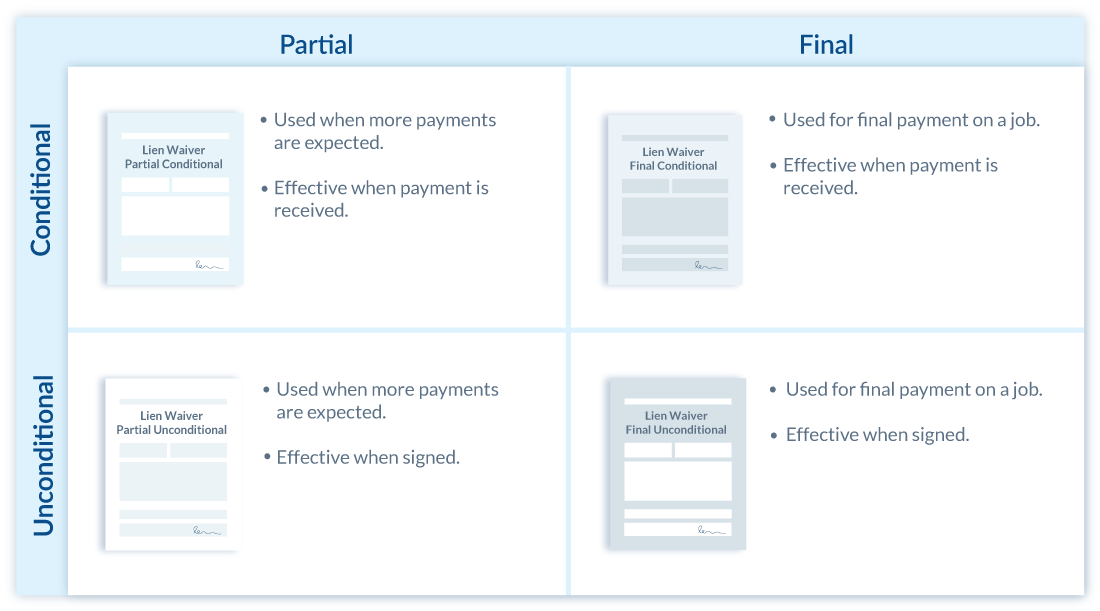

Overview of 4 Types of Lien Waivers

Items #1 and #2 above stress that you’ll want to examine the type or category of lien waiver being presented to you. However, the two sections address them separately — as a conditional v. unconditional category, and another partial v. final category. In fact, though, these are all intermingled together to create 4 types of lien waivers.

We discuss the 4 types of lien waivers in more detail within our Ultimate Guide to Lien Waivers. However, it’s important to provide an overview here, which you can see below. We have also included our video explaining these 4 types.

Here is a quick description of the 4 lien waiver types:

Conditional Waiver for Partial Payment:

A partial conditional waiver should be used when you are expecting to receive a progress payment on the project. You may be expecting future payments on the project, but are looking to sign a waiver for a specific progress or partial payment that you are receiving. Because this is a “conditional” waiver, you may not have received the payment. That is okay. A conditional lien waiver is “conditional” on your receipt of the payment and will be invalid if payment is not ultimately received. If you have already received this payment in full, then you will likely want to consider signing an “unconditional” waiver.

Conditional Waiver for Final Payment:

A final conditional waiver should be used when you are expecting to receive final payment on the project. After signing this waiver, in other words, you will not be expecting any future payments. Because this is a “conditional” waiver, you may not have received the payment. That is okay. A Conditional lien waiver is “conditional” on your receipt of the payment and will be invalid if payment is not ultimately received. If you have already received payment in full, then you will likely want to consider signing an “unconditional” waiver.

Unconditional Waiver for Partial Payment:

This waiver should be used when you have received a progress payment on the project. You may be expecting future payments on the project, but are looking to sign a waiver for a specific progress or partial payment that you are receiving. Because this is an “unconditional” waiver, you must have actually received the payment. If you have not received the payment, if the check hasn’t yet cleared the bank, or if there is some other reason why payment might ultimately fail, this waiver should not be furnished. If this is the case, you will likely want to consider signing a “conditional” waiver.

Unconditional Waiver for Final Payment:

This waiver should be used when you have received final payment on the project. After signing this unconditional lien waiver, you will not be expecting any further payments in the future, and are confirming that you have received — in hand — all payments owed to you on the project. Because this is an “unconditional” waiver, you must have actually received the payment. If you have not received the payment, if the check hasn’t yet cleared the bank, or if there is some other reason why payment might ultimately fail, this waiver should not be furnished. If this is the case, you will likely want to consider signing a “conditional” waiver.

Warning About “Waiving” Lien Rights Early

General contractors, owners, construction lenders, and other stakeholders put a lot of work in to avoid a mechanics lien filing or a bond claim. The entire lien waiver process is to achieve this. And it’s a pain to administer (as we explore in How to Handle Requesting & Tracking Lien Waivers).

Therefore, at times, parties will try to eliminate their exposure to lien rights right from the start of the job. They will try to bury a “waiver of all lien rights” clause within the construction contract or ask you to sign a separate lien waiver document right at the start of construction before you have done any work.

Be very careful about these practices. Here are a few times when you definitely should not sign a lien waiver:

- DO NOT sign a lien waiver before or at the start of a project (what we call “No Lien Clauses”).

- DO NOT sign a lien waiver at the same time that you sign a construction project contract.

As we’ve addressed in the past on this blog, this is sometimes against a state’s public policy and therefore, invalid. However, the act is valid and enforceable in other states (so be careful).

Are You Being Asked to Sign an “Unfair” Lien Waiver?

In Texas, a general contractor and property owner got into an argument over $20 million in damages and unpaid bills. The contractor argued the money was due, and the property owner argued that it didn’t matter…because the contractor had waived all rights to the payment.

After a three-month jury trial, the trial court ruled in favor of the contractor and awarded $20 million. Two years later, a Texas appeals court gutted the decision and awarded $10m in attorney fees to the owner. Then, after another two years of litigation, the Texas Supreme Court weighed in and reversed the appeals court, holding that the contractor was indeed owed the $20m.

This was a high stakes, long, and expensive legal tangle over a simple lien waiver document. How did it happen? More importantly, how do you avoid this type of situation when it comes time to sign a lien waiver?

Is The Industry Too Comfortable With Lien Waivers?

The contractor in this story is Zachry Construction, and they were suing the Port of Houston for payment on a job. The Port of Houston didn’t really argue that the $20m in damages and unpaid bills were incorrectly calculated. Instead, they simply argued that Zachry’s claims for that payment had been waived.

One of the Port’s primary arguments was that the contractor had signed an “Affidavit and Partial Release of Lien” that waived all claims. According to that argument, calculating the $20m in damages and unpaid bills was irrelevant because the contractor had accepted payment and signed a lien waiver forfeiting those claims.

The trial court, appeals court, and Texas Supreme Court spent five years interpreting a simple, unsuspecting, tiny one-page lien waiver, and each came up with different interpretations that had a $20+ million impact. It is an understatement to say that – at the time of signing that lien waiver – Zachry Construction was unaware of its significance. In fact, it’s much worse than that. Pen was put to paper on the lien waiver without even a second thought about the document. Signing lien waivers, after all, is a pretty common occurrence.

It is an understatement to say that – at the time of signing – Zachry Construction was unaware of lien waiver document’s significance.

Everyone in the construction industry knows what a lien waiver is, and these documents are signed thousands of times every day. In fact, that’s likely the industry’s biggest problem. Lien waiver documents are exchanged like insignificant receipts, but contain a ton of complicated legal provisions that twist all types of legal rights inside out.

And do we rely on attorneys to read these thousands of lien waiver documents every day?

Well, no, the industry relies upon credit managers, collectors, bookkeepers, and other administrators. These administrative workers are praised when they get money in the door…not when they make a “great lien waiver decision.” Arguing over lien waiver language doesn’t get any accolades. Getting money in the door does.

Exchanging lien waiver documents — regardless of what they say — for cash isn’t just acceptable, it’s a reality. And it’s really, really dangerous for all parties.

Robo-Signing Lien Waivers Is Russian Roulette

Every time payment is made related to a construction project, the payor and the payee sit at opposite sides of the lien waiver exchange. The paying party wants to hold back payment until a waiver is signed to protect them against potential lien claims. The party getting paid wants to get the cash as immediately as possible.

Both parties play Russian Roulette when they don’t care about the contents of the lien waiver. Let’s examine the problem from both perspectives.

The Paying Party: Lien Waivers For Those Wanting to Limit Lien Exposure

Many industry participants know about Textura’s Construction Payment Management application. The application promises owners and general contractors reduced exposure to mechanic lien claims by optimizing the process of collecting lien waivers. In assisting contractors and owners with the process of collecting lien waivers, Textura is agnostic about what the lien waivers actually say.

The lien waivers can say whatever the general contractor or owner wants them to say, and Textura will blindly require subcontractors to sign them as a condition to getting paid.

While this may appear to be suitable for those wanting to limit their lien exposure, not caring about the contents of the waiver presents a bit of a problem. It enables abuse. And that came up in a New York Supreme Court (Kings County) July 2014 opinion regarding construction of the Brooklyn Barclays Center.

In The Laquila Group, Inc. v. Hunt Construction Group, Inc., here is what the court had to say about Textura’s lien waiver exchange:

Plaintiff argues that, as the releases appeared on forms required for payment, the forms acted only as receipts and did not convey a true intent by the parties to waive all claims…The Appellate Division has, in factually similar cases, found questions of fact concerning the intent of parties executing purported release and the applicable scope of such agreements…

What does this mean?

The general contractor on the Barclay’s Center project required all subcontractors to electronically execute it’s “lien waiver” to get paid. There seemed to be little negotiating room on the waiver, and the waiver’s contents didn’t exactly sync up with correspondence between the parties or payment reality. Not caring about the lien waiver and just wanting to get the thing signed, in other words, has jeopardized the enforcement of the lien waiver in this New York case.

Paying Party’s Perspective: Just wanting the waiver signed and getting as much legal protection jammed in as possible.

The Problem: Courts will invalidate waiver language and processes that are unfair, thus jeopardizing all liability protections.

The Party Getting Paid: Lien Waivers For Those Wanting Cash Fast

It doesn’t always go so well for the parties signing lien waivers. The introduction to this article gave the Zachry Construction example where a lien waiver cost the company 5+ years of litigation, and risk $20+ million in payments. This type of interpretation on lien waivers happens all the time.

When it comes time to get paid, it’s so easy to sign a document in exchange for a check. What could go wrong? After all, you do this thousands of times and it never causes a problem. When it comes time to get paid, it’s so easy to sign a document in exchange for a check. What could go wrong? After all, you do this thousands of times, and it never causes a problem.

It never will cause a problem…until it does.

In most situations, the parties exchanging a lien waiver will not find themselves in a dispute, and the lien waiver will not get tested. Nevertheless, when disputes arise, lien waiver documents are too frequently cited, and they can absolutely crush a claim.

Those who think of lien waivers as a means of getting paid and who let anyone in their company approve and sign the documents are playing Lien Waiver Roulette.

Payee Party’s Perspective: It’s just a lien waiver, and we need the cash. Sign and get on with it.

The Problem: Waivers can contain all sorts of unfair language, and it came come back to bite you hard.

When Is A Lien Waiver Unfair?

The parties on both ends of a construction payment can get burned by poor lien waiver practices. Interestingly, as discussed in the preceding sections, both parties can be burned by the same thing: lien waivers that are unfair.

Lien waivers are a very important document for construction industry players, and these documents must certainly exist. Furthermore, everyone in the industry generally wants the documents to be fair. But, what exactly is the difference between a fair and unfair lien waiver?

A. It’s Unfair To Push Lien Waivers That Violate Statutory Requirements

It may be complicated to keep track of all the lien waiver rules, but nevertheless, it’s important for companies to do so. There are 13 states that specifically mandate what lien waiver documents must say, and state legislatures are quickly jumping on this area. When state law mandates that a lien waiver contain certain text…it’s unfair and illegal to request someone waive their rights using another form.

Companies performing work in a regulated waiver state shouldn’t sign waivers that don’t match the statutory form…and shouldn’t request others do so.

B. It’s Unfair To Use Lien Waivers To Change The Terms of a Contract

The lien waiver document is a contract document that contains significant contractual provisions. Predatory companies will use the lien waiver document as a means to sneak in terminology that alters the contractual relationship between the parties.

Predatory companies will use the lien waiver document as a means to sneak in terminology that alters the contractual relationship between the parties.

Lien waivers, however, are not meant to do this. They are simply meant to act as a receipt for the parties. One party pays an amount that the other party receives, and the lien waiver is designed to memorialize that transaction and cancel out any lien rights associated therewith. Waivers that seek to do more are unfair.

C. It’s Unfair To Ask For Unconditional Waivers Before Money Is Exchanged

Are you being asked to sign an unconditional lien waiver when money is not in hand? Yes, this includes electronic waiver exchange platforms that promise to hold your waiver in an “escrow” until payment is hand.

Unconditional lien waiver requests when payment is not in hand is predatory, unnecessary, and unfair.

Here is what attorney Nate Budde said about conditional and unconditional lien waivers in his article, Court Saves Material Supplier from Lien Waiver Mismanagement:

An conditional waiver still waives the lien right (like the higher party wants) but does so only upon the actual receipt of the payment owed. This makes too much sense to be as big a sticking point as it appears to be in this industry. Providing an unconditional waiver prior to receiving payment is poor receivables management, it throws away having a secured position on the project for nothing. A conditional waiver, on the other hand, does not effect the right to lien (and thus does not effect the claimant’s secured position) until payment has been made. And at that point, the lien right is unnecessary.

This makes so much sense. If you’re being asked to sign an unconditional lien waiver on unfair terms…the request is unfair. Sometimes, a spade is a spade.

Frequently Asked Questions When Deciding Whether To Sign A Lien Waiver

If you ever have questions about lien waivers, head over to our Expert Center and ask a payment expert or construction law your lien waiver questions for free. We get new lien waiver questions posted and answered in our Expert Center nearly every day. You can take a look through all of the lien waiver expert answers and advice here.

Here’s a selection of some of the most frequently asked questions people have when it comes down to deciding whether they should or should not sign a particular lien waiver.

Should I Sign A Lien Waiver That Lists $0 As The Amount Paid?

It is surprisingly common that contractors will be asked to sign “$0 lien waivers” (we’ve also seen $10 lien waivers). The idea here is to hack the difficulty of creating a new waiver for every payment on a job. I get it. It sounds easy and straight-forward. The problem is that these types of inaccurate lien waivers can create problems. Attorney Matt Viator sums up why it creates problems nicely in his answer when he says that “ultimately, using a zero dollar waiver is a manipulation of Florida lien waivers.” And if you’re doing to manipulate lien waivers and lien waiver rules, then you’re probably skating on thin ice. For more on this answer and to see why Matt suggests that things could go wrong with $0 lien waivers, take a look at the question here: Are zero dollar final releases legal?

Should I Sign A Lien Waiver on the form that the GC requires?

Another very common area where people have questions is about the lien form itself, and namely, people wonder whether general contractors (or owners) can require and mandate that they sign a particular form. In one question on our Expert Center, a subcontractor in Tennessee explained a very common catch-22 situation for subs: “Our supplier provides a lien waiver but not on the form that general contractor supplied to us. The general contractor rejected it and said it had to be on their form. The supplier is not willing to provide the lien waiver on the general contractor’s form.” What can a subcontractor do? What are they obligated to do? Read the question on our Expert Center to see the advice given for this tricky situation: Can a general contractor require a subcontractor’s supplier to provide a lien waiver on the general contractor’s supplied form and not on any other form?

Should I Sign An Unconditional Lien Waiver Before Getting Payment?

Super-duper NO! We explored this at length already in the early part of this article, but we see this question over and over and over again on our Expert Center. There is a lot of pressure to sign lien waivers, and it’s common for subcontractors and suppliers to confront this situation and really be tempted to just sign. The likelihood of something bad happening is admittedly probably low…but, boy, when it happens…it happens! The attorney expert who answered this question did a nice job summing up the problem, saying “Clearly when payment is still owed, providing an unconditional waiver form is likely not a good idea. Instead, offering to submit a conditional waiver – such as the Conditional Waiver and Release on Final Payment set out by § 8136 – is typically a better idea.” Read more here: Should I sign an Unconditional Waiver And Release on progress payment form if I have not been paid in full.

Should I sign a waiver with an electronic signature, or should I sign it with ink?

Electronic signatures are extremely popular these days and only getting more popular. You can buy a house now with an electronic signature! When it comes to lien waivers, electronic signatures are valid everywhere (thanks to the federal electronic signature laws!). There are lots of contractors, developers, owners, and suppliers using lien waiver software, too, which makes lien waivers with electronic signatures easier than ever. But, people still have questions about this, and good ones. Check out this question on our Expert Center, for example, about whether electronic signatures on waivers has ever been challenged or upheld in court: Has an electronically signed lien waiver been challenged in court?

Conclusion & Things To Remember

Here are some quick takeaways and things to remember.

- If you are unsure which of the 4 possible lien waiver forms you should use, then you should use this form, the Conditional Waiver and Release on Progress Payment form. It is the safest choice of the four.

- Pay attention at the time of contracting…it’s common for: (i) aggressive contractors or owners to seek waiver of lien rights early, before work begins, and (ii) The lien waiver form itself is sometimes agreed to within the construction contract.

- Don’t be afraid to speak up and ask for clarifications, or for a change to the lien waiver form. It’s very common for companies to go back and forth about construction waiver/lien release language.

Most of the time, doing the right thing with lien waivers isn’t rocket science — it just requires paying attention. Spend a few moments with your lien waiver, and you’ll be fine. And of course, you can always get in touch with us.