If you want to file a mechanics lien on a construction project in New York, this step-by-step guide will help you get it done. However, before blindly jumping into a lien filing, it’s important to note that there are specific timing (and other) requirements that must be met before filing a valid mechanics lien.

Read the full requirements: New York Mechanics LienGuide & FAQs

It’s a plain fact that construction industry participants routinely are forced to struggle with payment problems. Slow payment occurs too frequently, and non-payment is also prevalent. Thankfully, construction industry participants in all 50 states have a tool called a mechanics lien to combat these problems. Let’s take a look at the steps you need to follow for the mechanics liens process in New York, and how to file.

How to file a mechanics lien in New York

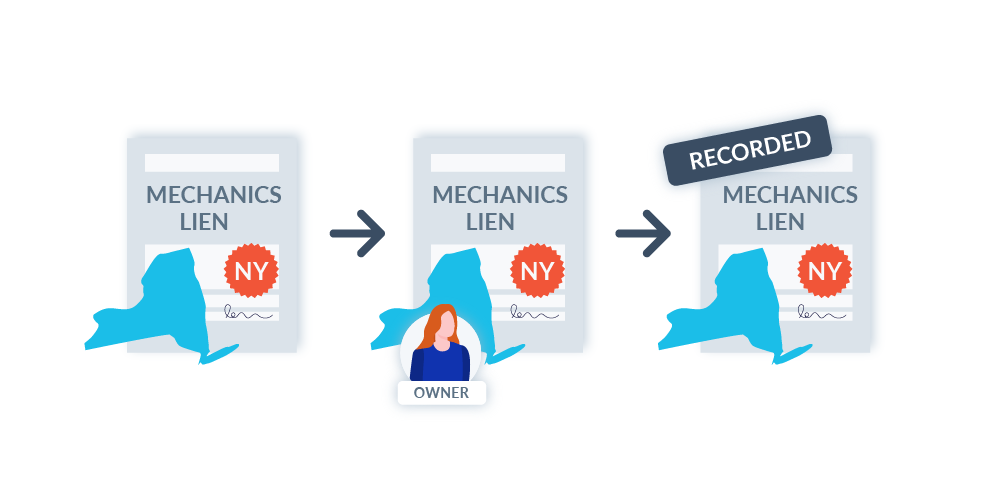

Filing a New York mechanics lien involves 3 steps:

- Fill out the proper NY mechanics lien form

New York law sets specific requirements for the form to use when filing a mechanics lien claim. Make sure you use a claim form that meets state guidelines, and fill it out completely and accurately. Download a free NY mechanics lien form here.

- Serve a copy of the lien on the property owner

You must notify the property owner of the lien. You can serve notice 5 days before and up to 30 days after filing the notice of lien. Failing to serve notice will invalidate your lien claim.

- Record the lien with the NY county recorder

File the lien claim with the NY county recorder’s office in the county where the property is located.

- File an Affidavit of Service

You must also file an Affidavit of Service, showing that you provided notice of the lien to the owner. If you serve a copy of the lien to the property owner before recording, you can file the Affidavit of Service at the same time as the lien itself.

Get a free New York mechanics lien form

Download a free mechanics lien form for New York, prepared by construction attorneys to meet the legal requirements.

Watch the Video: How to file a lien in New York

Step 1. Fill out the mechanics lien form

Use the right lien form

The first step to properly filing a lien claim is relatively obvious; the claimant must use the proper mechanics lien form. The legal requirements imposed by the state of New York are fairly strict.

Be careful to ensure that the lien form you use meets the NY statutory requirements. Numerous resources provide mechanics lien claim forms, but you can never be sure if they are accurate or valid.

Information required on a NY lien claim form

A New York mechanics lien must contain the following information. Leaving out some information, or even just getting it wrong, is more than just a simple mistake.

1. Claimant’s name and information

This is you! Fill out your full name and address. This seems pretty basic, but be sure to fill out your information properly. New York courts are a bit inconsistent when it comes to the details in a mechanics lien claim.

For instance, in one scenario, a New York lien was invalidated because the claimant’s name was slightly incorrect. In another scenario, the court decided that a lien amendment can be filed when the name is wrong.

What’s the lesson here? Fill out your information carefully.

Note that, if the lienor is a partnership or a corporation, the lien must include the business address of such firm, or corporation as well as the names of partners and principal place of business.

And if the lienor is a foreign corporation (meaning not registered in the state of NY), the lien must include a statement of the lienor’s principal place of business within the state.

This is can be a wrench in the works for a lien claimant if they do not have (or are not required to have) a business address in the state, and can result in difficulties in getting a New York lien recorded.

There could be some additional information required here. If you are being represented by an attorney, you should include their name and address as well. Also, if you are an architect or engineer, you should provide your license number on the lien claim.

2. Property owner information

This is an easy one if the property owner’s information is readily available. But sometimes it’s not. In other cases, there may be more than one owner, or the property is sold throughout the course of the project. Another issue could be if the tenant. If that is the case, be sure you can file a lien in the first place. In New York, the owner must have given the tenant consent for you to be able to file a lien.

3. Hiring party information

Here’s a gimme. This is who contracted with you to work on the project. All the relevant information should be contained within your contract. If you were hired directly by the property owner, then just repeat that info in this section.

4. Statement of labor or materials provided

In this section, you simply need to list out the work or materials that you provided to the construction project that is subject to the lien claim. This should include the agreed price or value of the work or materials. Including any materials that were actually manufactured for, but not delivered to the property.

5. Lien amount

The lien amount is the unpaid amount for the labor or materials that are subject to the lien claim. Do not mess around with this number. The lien amount can be no more than the amount of money earned and unpaid.

Yet, there is still plenty of confusion regarding what costs to include:

- Can we put the cost of the lien in the lien or the back finance charges?

- Can legal fees and interest be included in the total contract amount?

Any temptation to add more than the cost of labor or materials performed should be avoided. It can not only invalidate the entire lien, but there could be severe consequences; such as liability for a fictitious lien.

6. First and last dates of performance

Another easy one here: This is simply the first and last dates you were on the job site. If you are filing your lien claim while the project is still ongoing, this will still be the last date you provided labor or materials to the project — not the date the contract is estimated to be finished.

7. Property description

The property description for NY mechanics liens is only required to be sufficient for identification. This means that a simple street address would be enough to correctly identify the property to be liened.

There is one exception, however, and that is the legal description in New York City. If the project is located within the city limits, the property description will need to include the block and lot number where the property is located.

In addition to that, all mechanics lien forms also require a statement indicating whether the property is “real property improved or to be improved with a single-family dwelling” or not.

8. Signature and notarization

It’s just about time to sign your lien claim form, but remember that NY mechanics liens need to be “verified” by the claimant or their agent. This is a short statement verifying that the information provided is true and accurate.

Do not sign the form, unless you are in front of a notary! A lien claim will not be valid unless it is properly notarized.

Learn more about notarizing mechanics liens remotely

Also, if an agent is signing on your behalf, they must be authorized to do so. This can be achieved by including a short, simple document authorizing that you are granting that person or company to sign documents on your behalf.

Step 2. Serve a copy of the lien

New York requires that a copy of the lien be served on the owner of the property. The copy of the lien must be served within 5 days before, or 30 days after filing the notice of lien.

Failure to file proof of the service will be fatal to a lien. Lien claimants other than the general contractor should also serve a copy of the lien claim on the general contractor.

You may be asking yourself, in NY does the person getting the mechanics lien have to be personally served, or will regular mail be sufficient?

Fortunately, the statute provides a bunch of options that will be considered valid; in person, leaving it with someone at their residence or business, certified mail, or even merely posting it on the job site during peak work hours.

Step 3. File your New York mechanics lien claim

Now it’s time to get your New York mechanics lien filed in the clerk’s office of the county where the property is situated. (Note: If such property is situated in two or more counties, the notice of lien shall be filed in the office of the clerk of each of such counties.)

View a list of all New York recording offices

Deadline to file

One of the most important requirements when filing a New York mechanics lien is making sure that the lien is filed on time! The deadline to file depends on the type of project you are working on.

The general rule: In New York, a lien can be filed any time during the project or within 8 months after completing the contract or last providing labor or materials.

If, however, the project is a single-family residence, then the deadline is a shorter: 4 months from completion or final furnishing.

Here’s an interesting scenario: What if you are converting a two-family home into a single-family residence?

Where to file

Mechanics liens in NY must be filed in the clerk’s office of the county where the property is located.

Note that your lien document must also comply with any specific margin requirements that a particular county may have, as well as potentially requiring a county-specific cover page.

In order to make this process easier, we’ve put together a list of all the New York county clerk’s offices and links to their websites.

How to file

In-person or by mail

The lien may be delivered to the proper register of deeds via mail or FedEx, or personally “walked in” to be recorded (either by you or a courier). Keep in mind, that if you’re mailing your NY lien claim in or sending it with a courier, include a self-addressed, stamped envelope so you can receive a copy of the recorded lien for your records.

Also, make sure to include the proper recording fees with the lien. Liens are often rejected for improper fees (even if you provide too much money).

Any delay caused by needing to resubmit the lien for recording takes time. Since liens are time-sensitive documents, improper fees can possibly result in a missed deadline. Recording fees vary from county to county and can be determined by calling the county clerk, checking on the county recorder’s website.

If you’re bringing the lien in for filing, you can ask in person.

Electronic recording

Some counties in New York may allow for mechanics liens to be electronically recorded — but this is not too common. If available, and you choose this method, you will need to upload a copy of your lien to the electronic recorder system you will use, and follow the instructions.

Be careful to pick the appropriate document type in the particular county.

Step 4. File an Affidavit of Service

Although the statute allows for lien claimants to send notice within 30 days after the filing, a lien claim also requires the filing of an Affidavit of Service, within 35 days of filing your claim.

Practically speaking, it may just be easier to serve the lien in the 5 days before recording, so both the claim and the affidavit can be filed together.

You’ve filed a lien – what’s next?

Foreclosure action

Even if your lien is valid, it could take a lawsuit enforcing your claim in order to get paid. While an enforcement action on a valid lien nearly always results in payment, foreclosure can be a long and expensive process.

A New York mechanics lien generally stays effective for 1 year from the date the lien was filed. That means a claimant will have a year to try and negotiate and resolve the issue before filing an enforcement suit would become necessary.

Note, though, that adding another step in between a lien filing and an enforcement action can help recover payment without resorting to a lawsuit. Sending a Notice of Intent to Foreclose can show recipients that you mean business about getting paid, without having to get the lawyers involved.

Plus, since it’s cheap and risk-free, you can always file an enforcement action if the Notice of Intent to Foreclose doesn’t do the trick.

Extend your deadline

If you are not ready to file an action to foreclose, there is another option. New York is one of the few states that allow for the extension of the foreclosure deadline.

If you file a New York Extention for Mechanics Lien Form, within the one-year enforcement deadline, you can extend the deadline for another year. A second extension may be possible only through petitioning the court for approval for the extension.

The deadline timing can get a little tricky here. Is it when the petition is filed? Or when the judge actually receives it?

Well, there was a recent case where the petition was filed before the deadline, but the judge didn’t receive it until after the deadline had passed. The court allowed for the extension.

There is, however, one type of project where the extension rules operate a bit differently: single-family residences. Extensions for liens filed on these types of properties may only be done by court order.

Here’s an interesting question that came up in our Ask an Expert Center a while back: Is there a legal requirement to file an affidavit of service when one files an extension of mechanics lien in NYC?

Release the lien claim

Lastly, if you’ve been paid, the property owner will likely request that you release (i.e., cancel the lien). This is accomplished by filing a NY Mechanics Lien Release Form stating the lien has been satisfied with the same county clerk’s office where the lien claim was initially filed.

That’s the whole process! Remember that even valid and enforceable liens may be challenged, and if you missed a step somewhere along the way, your lien could be thrown out. As long as you follow these steps carefully, you’ll be well on your way to ensuring you get paid what you’ve earned.