“I’m starving for cash!!”

~What a construction company would say if it could talk

“Cash is King” is one of the most enduring sayings in business, and that’s because it’s true. What it means is that, while your financial numbers (and especially, your revenue) may look good on paper, actually collecting on those revenues and getting that money into the door and into your bank account is what really matters.

But here’s another business saying that may not be as well known as the one above, though it’s no less true: “Growth EATS Cash.” Why? Because business growth doesn’t just happen, it needs to be fueled. And the fuel is cash – money spent, invested, paid out, and used in order for a company to be able to take on more business.

While both of these sayings are true for just about any business in any industry, as we all know, managing cash flow in the construction industry is particularly challenging. So, if you’re lucky enough to be at a construction company that has the opportunity to grow, how much cash will it take to fuel that growth? If it’s true that growth eats cash, how much cash will you need to get your hands on in order to feed the beast?

Good News / Bad News for Construction

First the Good News:

Market forces, economic trends, expected growth, and a massive pipeline of much-needed, large-scale construction projects all point to one conclusion: the construction industry is poised for significant, sustained growth. This means that, if you’re in the construction business, congratulations, you have a huge opportunity before you to take advantage of the coming industry expansion and grow your business in a way that hasn’t been possible since long before the most recent recession. That’s the good news.

And Now for the Bad News:

Construction businesses are more likely to fail in a growing economy than in a declining economy. How likely, you ask? For subcontractors, the answer is three times more likely, according to Thomas Schleifer, PhD, of the Del E. Webb School of Construction.

Seems crazy, doesn’t it? Businesses are supposed to fail during an economic downturn, not during an economic expansion. How is it possible that a growing economy is somehow more of a survival threat to construction businesses than a declining one?

How is this Possible?

Let’s take a moment to clarify a very important issue: what causes a company (any company) to fail? The simplest reason why a company fails (and the most common) is because that company ran out of cash. And running out of cash is an easy problem to have in the construction business because it takes a huge amount of cash for a construction firm just to fund its normal operations. There are lots of reasons for this, but 3 of the most significant drivers of the construction cash crunch are:

Floating project/job costs up front is expected

Your cash starts going out the door on a new project/job immediately

Slow-payment in construction is the norm

The cash coming in the door from your customers is slow to arrive

Retainage, change orders, and underbillings are prevalent

Construction-only practices like these all serve to further complicate the collection of construction payments which has a negative impact on cash flow

In other words, before a construction business owner can worry about the cash needed to fund growth, he has to worry about the cash that his business is already using. Or in other words, for construction businesses, it’s not just growth that eats cash. In construction, just your normal business operations eat a ton of cash! See the next section for a brief illustration.

Why Do Construction Companies Need So Much Cash for Normal Operations?

In order to illustrate the cash-starved nature of the construction business, imagine the following scenario:

A subcontractor has an opportunity to grow by taking on a new job in addition to their existing jobs. They are already at full capacity, but the owner feels like they can’t pass us this opportunity. The new job is supposed to have a 6-month timeline with a contract value of $332,000.

Let’s take a closer look at the cash that subcontractor is going to need just to keep the project moving forward…

- Contract Value: $332,000

- Timeline: 6 months

- Retainage: 10%, balance coming in last customer payment

- Labor cost: 5%, paid weekly

- Direct overhead: 7%, paid weekly

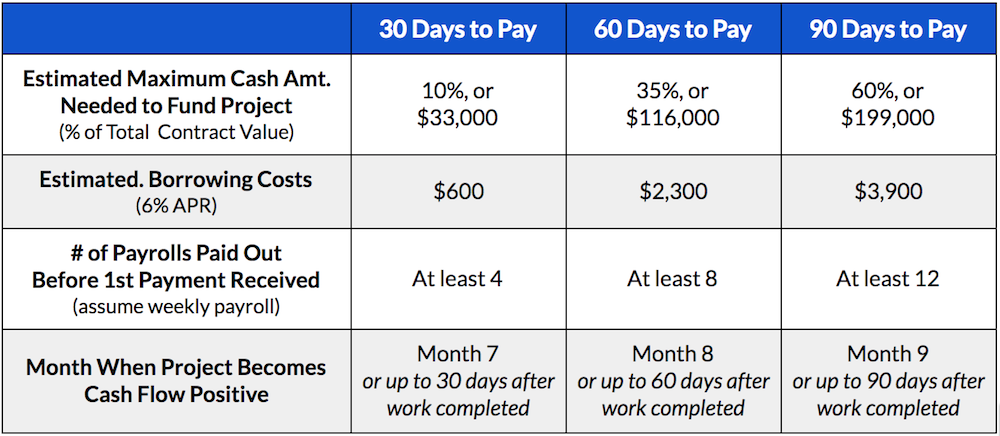

Table: What happens to the subcontractor’s cash flow when it takes their customer 30 days to pay? What about 60 days, or 90 days?

Is the cash need really that bad?

Yes, it really is that bad. If it takes your customer 90 days to pay you (after you invoice them on day 30) then you’re going to need almost $200,000 of cash available and on hand just to be for you to keep us with the essential costs associated with the project. Just think about how your average job unfolds in the real world. The costs and expenses of a new project don’t wait for your customer’s payments to roll in.

Payroll? Can’t delay your payroll! You need to pay your people on time and in full every week no matter how long it takes your customer to pay you.

Overhead? It’s going to be difficult to work if your electricity is cut off and you don’t have any fuel in your work trucks and machinery!

When you throw in the added burden of retainage, it’s very likely that a contractor, sub, or sub-sub to be cash flow negative for a significant portion of a project/job timeline. In fact, it’s not unusual for the negative cash flow to last for the entire duration of the project, only moving into the black when the final project payment (which includes the retainage) is received. And if your labor costs, your overhead, or the project retainage are higher than normal, then the depth and the duration of your cash crunch is only going to increase.

What can be done to Improve Project Cashflow?

Here’s what’s really going on in the scenario above: the real reason why the subcontractor in the example above needs so much cash to keep that project going, the lights on, and his people paid is because of how long it takes for his customer to pay their bills!

Or in other words, the faster your customers pay you, the less cash you’ll need to fund your existing projects, and the more cash you’ll have on hand to take on new jobs and grow your company!

We know what you’re thinking — Slow payments are just a fact of life in construction…Everybody deals with slow payments…it’s just the way that it goes, and there’s nothing that I can do about it. But what if that’s not true? What if there is something you can do about it?

If You Send Preliminary Notice, You’ll Get Paid Faster

Most large or sophisticated property owners, and nearly all developers or large GCs, go to great lengths to track who is filing and not filing notices in order to know which parties have protected lien rights and remain in a secured position.

So, when it comes down to who is going to get paid first on a project, the companies that have secured their lien rights (by sending preliminary notice) are always going to be paid before the companies that haven’t, because the fear of a possible mechanics lien is just that great.

The companies that didn’t secure their lien rights are always going to be better candidates for delayed payments because, without the ability to file a lien, there’s nothing they can really do to make the payment come any faster.