The Arizona Prompt Payment Act sets out guidelines for the timely payment of general contractors and subcontractors working on private construction projects in Arizona.

The entire statute makes sure that owners pay contractors and subcontractors periodically over the course of a private construction project for work completed. It basically creates a standard payment billing cycle to ensure everyone is getting paid on time.

For organizational purposes, the first half of this post will cover the relationship between an owner and a prime contractor. The second half will discuss payments between contractors and subs, as well as the rest of the payment chain.

Prompt Payment for Arizona Owners and Prime Contractors

If a private job will take 60 days or longer to complete, the Arizona Prompt Payment Statute will apply. For those projects, owners are required to make progress payments and billing cycles are automatically set to 30 days. Of course, a different billing cycle may be utilized, but to utilize a different cycle, extra notice must be given.

Can Payments Be Withheld?

An owner may withhold payment to the prime contractor for the following reasons:

- Unsatisfactory job progress

- Defective construction work or materials

- Disputed work or materials

- Failure to comply with provisions of the contract

- 3rd party claims filed or reasonable evidence that a claim will be filed

- Damage to the owner

- reasonable evidence that the contract cannot be completed for the unpaid balance of the contract sum, or

- failure of the contractor or subcontractor to make timely payments for labor, equipment, and materials.

Note, of course, that reasonable amounts for retention may also be withheld.

If one of the above reasons is present, the owner may withhold payment. But, they may only withhold an amount to cover the expenses the owner expects to face based on the reason for withholding payment.

For example, insignificant damage to the owner’s property can’t hold up the entire invoice – only an amount that would cover the damage may be withheld.

If payment is being withheld from the contractor, and as a result, that contractor is unable to make full payment to one of their subs or suppliers, the contractor must send notice to those who will not be paid in full.

What’s the Timeline for Payments?

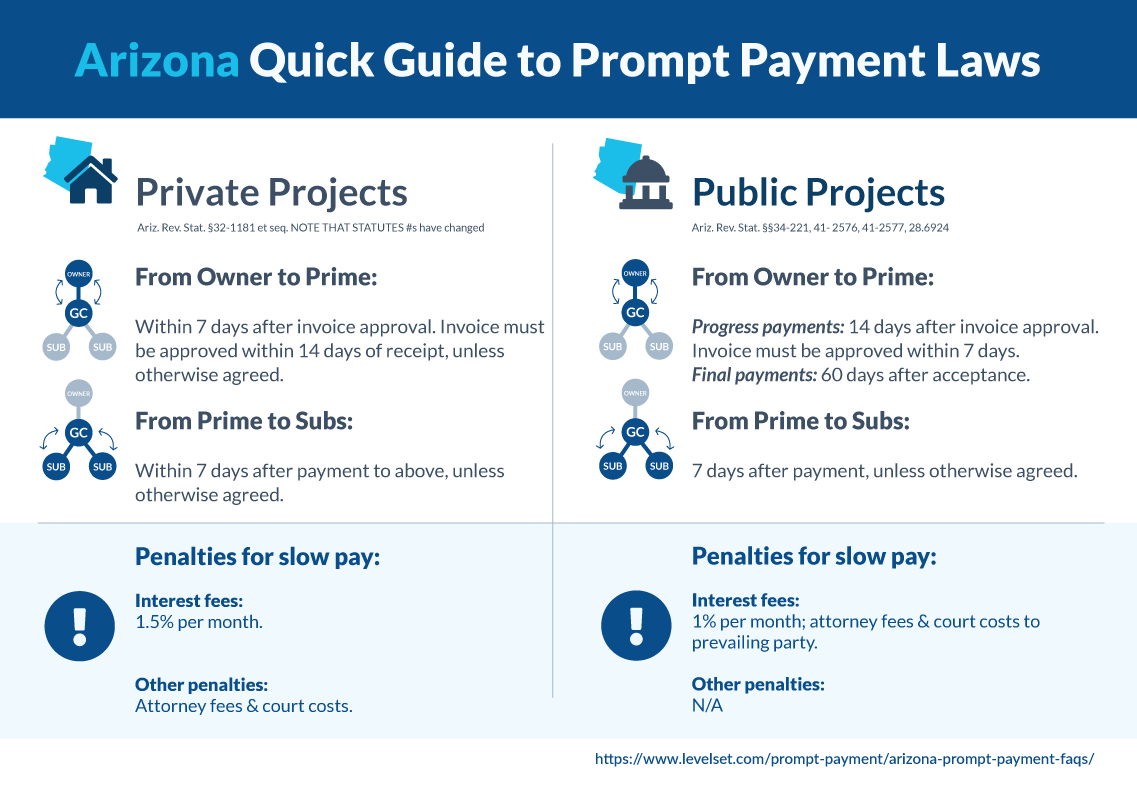

Once a contractor submits an invoice to the owner, the owner has 14 days to respond. If there’s a dispute, the owner must issue a written statement detailing items that are not approved and certified. If no written response is given, the invoice is automatically considered certified and approved.

So, if no dispute exists, a contractor’s invoice must be paid within 21 days of an invoice (14 days for the owner to respond, plus 7 days to make payment). If payment runs late, interest starts accruing at 1.5% per month (or at a higher rate agreed to under contract).

Prompt Payment for Arizona Subs and Suppliers

The general contractor must pay their subcontractors and suppliers within 7 days of receiving payment from the owner. Further, if a subcontractor is employing a subcontractor or supplier of their own, they must also make payment within 7 days of receiving payment.

In conjunction with the timeline above – this means that a first tier sub can expect to wait up to 28 days for payment if everything goes according to plan. For sub-subs or suppliers hired by a subcontractor, this can be a 35-day wait.

When a payment is not being withheld for one of the reasons below, interest penalties accrue. Interest accrues at 1.5% per month (or at a higher rate agreed to under contract).

Withholding From Subs and Suppliers

Note, also, that a contractor or sub may withhold from lower-tiered parties for the following reasons (these should look familiar):

- Unsatisfactory job progress.

- Defective construction work or materials not remedied.

- Disputed work or materials.

- Failure to comply with other material provisions of the construction contract.

- Third party claims filed or reasonable evidence that a claim will be filed.

- Failure of the subcontractor to make timely payments for labor, equipment and materials.

- Damage to a contractor or another subcontractor or material supplier.

- Reasonable evidence that the subcontract cannot be completed for the unpaid balance of the subcontract sum.

- The owner has withheld retention from the contractor

Look at the last bullet on that list. It might be alarming at first, but don’t stress.

If an owner withholds money from a contractor, that contractor can’t just withhold money willy-nilly from subs and suppliers. Instead, any withheld funds must relate to work provided by that sub or supplier. Plus, when someone other than an owner withholds payment, they have to give a detailed, written explanation of why payment is being withheld.

Recovering Payment Under the Arizona Prompt Pay Act

Interest penalties for late payments – sounds helpful, right? Companies should pay on time to avoid interest, not to mention it’s the right thing to do. So, getting paid on construction projects in the state of Arizona must be as easy as 1-2-3…

Unfortunately, in order to enforce rights under the Arizona Prompt Pay Act, a claimant would likely need to bring a lawsuit. As we’ve noted before, lawsuits can be risky, expensive, and time-consuming. But, if other options for recovery aren’t available (such as a lien claim), then forcing your customer to make payment via Arizona’s prompt pay laws is a solid backup plan. But there’s a better option before a lawsuit becomes necessary.

Leveraging the Arizona Prompt Pay Act Without Filing Suit

As much as everyone hates liens, companies and individuals hate lawsuits even more. As a result, the threat of filing suit can be really effective, especially when the person making the threat can cite specific grounds for suit – like the Arizona Prompt Pay Act.

A Notice of Intent to Make Prompt Payment Claim can help prevent actually needing to file suit. By sending a Notice of Intent to Make Prompt Payment Claim, a claimant can let the recipient know:

- Nonpayment and slow payment won’t be accepted,

- You’re aware of their rights under the Arizona Prompt Pay Act

- You aren’t afraid to do what it takes to recover payment

More about Prompt Payment in Arizona

- Arizona’s prompt payment law doesn’t apply to federal jobs

- Arizona gives designers protection under prompt payment law

Learn more about prompt payment laws across the United States.