The mechanics lien process is an important one to understand for those in the construction industry. That’s because securing your lien rights is the single most effective way to protect payments on private construction projects. However, this can involve a number of different forms, documents, and notices that must be sent to properly manage those rights. Two documents of particular importance are lien waivers and lien releases.

As similar as these sound, these are completely different legal documents, and are often confused for one another; particularly for contractors operating in multiple states. To try and clear things up a bit, let’s take a look at what each of these documents does so you can be sure that they are being used properly to manage your lien rights.

Lien waivers vs. Lien releases

What’s in a name? Lien waiver? Lien release? The distinction is important, but many in the construction industry use these words interchangeably. Which can create unnecessary confusion, in an already complicated process which is construction payment. One document is used to waive a certain amount of lien rights in exchange for payment, while the other document is used to release an already filed claim.

So what gives? Why is this so confusing for those in the construction industry? Well the problem stems from the fact that each state assigns different titles to these documents. Take Florida for example. The form used to waive lien rights is referred to as a “Waiver and Release of Lien.” While the form used to remove a filed claim from public record is referred to as a “Discharge of Lien;” which is also referred to in other jurisdictions as a release, cancellation, etc. For those expanding their construction business across state lines, the confusion is exacerbated.

In an attempt to simplify the distinction (when talking about mechanics lien laws in general), we here at Levelset like to look to the core function of each document. Both are executed in exchange for payment. But what are you actually trying to accomplish with the document? What is type of payment is being exchanged? Who is it being provided to? To answer these questions, here’s a brief overview of these two documents. That way you can properly determine which one to use, when, and how.

What is a lien waiver?

A mechanics lien waiver is used to waive lien rights. These documents are typically executed throughout the course of the project in exchange for payment. Lien waivers are used before a mechanics lien has been actually filed. Waivers are usually required by the owner or general contractor before they release the payment.

When a waiver is signed, the party is waiving that dollar amount of lien rights they have against the owner’s property. In that sense, lien waivers work a lot like a receipt for payment. For example, a party who receives $1,000 in payment, they will sign the document that waives $1,000 worth of lien rights to the project.

Different types of lien waivers

There are essentially four different types of lien waivers that one might encounter. They vary depending on (1) the type of payment being made, and (2) when the waiver is considered valid and enforceable.

As far as payment types go, there are different forms used for progress payments and those for final payments. Progress payment waivers will typically reserve rights to payment for any pending change orders or withheld retainage. While final waivers will waive all remaining lien rights for payment.

These two types of waivers are broken down even further into conditional waivers and unconditional waivers. A conditional lien waiver is the safer (and highly recommended) option. When a conditional waiver is signed, the waiver will not effectively waive those lien rights until payment is made. In other words, the payment is the condition that must be met before the document is valid. On the other hand, unconditional waivers are immediately effective upon signing. Don’t sign an unconditional waiver until you have cash in hand!

- These four types seem simple right? Not always, check out Georgia’s Very Unusual Rules for Lien Waivers

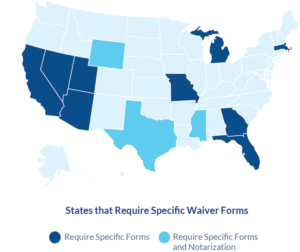

States with statutory lien waiver forms

There are currently only 12 states that specifically regulate the lien waiver forms and content. And three of these states require that these forms be notarized. In these states, any deviation from what’s required by statute could prove ineffective to waive your lien rights. With the exception of Florida lien waivers, where non-statutory forms may be used as long as the parties agree to do so.

In all other states, these forms are left up to the parties. However, when working in one of these “unregulated lien waiver states” be sure to review the terms carefully. Many times the lien waiver process can be abused by including the waiver of additional rights or claims. You can find a checklist of things to consider here: Should I Sign That Lien Waiver?

For a full breakdown of lien waivers, see:

The Ultimate Guide to Lien Waivers in Construction

What is a lien release (aka lien cancellation)?

What is a lien release (aka lien cancellation)?

A lien release is used to cancel a lien that has already been filed. Lien releases are also referred to as a release of lien, cancellation of lien, or a lien cancellation. These are typically used to cancel the filed claim from public records. I know what you’re thinking. Don’t liens just expire on their own?

True, liens will expire if not enforced within the required timeframe. But that doesn’t necessarily mean that the claim has been removed from the property title. Anytime a lien claim has been fully paid and satisfied, and lien release should be filed.

Filing a lien release

Unlike lien waivers, which are sent to the party making payment, lien release forms are filed in the county recorder’s office where the lien claim was filed. Although the form varies slightly from state to state, there is some general information that should always be included. Such as:

- Project address or legal property description

- Property owner’s name

- Lien claimant’s name

- Filed lien claim information (i.e. date of filing, book number, page number, etc.)

These lien release forms are filed in basically the same fashion as the lien claim itself. Be sure to contact the recorder’s office ahead of time to ensure that the release is in the proper format for recording.

When to release a lien claim

Once the debt underlying the lien claim has been satisfied, the lienholder is typically required to formally release the claim. In fact, there are a number of states that explicitly requires the claim to be released within a certain timeframe. Be sure to check your state’s rules on when and how to release a mechanics lien.

The deadlines for releasing a lien vary by state. Most states require that liens are released within 10-30 days of satisfaction or the date written request for release was received. Of course, there are exceptions. Maine provides a longer acceptable timeframe (60 days from satisfaction), while Washington’s statute says that a lien release is due immediately upon satisfaction or written request. Failure to do so on time can lead to some steep penalties and additional liability.

Even if this is not specifically required in your state, it’s generally good business practice to file the release as soon as the payment clears. Besides, you will likely be asked to do so by the property owner anyways.

Bottom line

Being able to distinguish between these two documents is incredibly important when managing your lien rights. While the ultimate goal for each is the same, taking mechanics liens out of the picture, the difference is crucial. And many contractors still confuse the two. Making matters worse, many states refer to their waivers as “mechanics lien waiver and release.” Whatever you want to call them, they shouldn’t be mistaken as the same thing. Each is used in different circumstances, and mistakes made with either one could be costly.

What is a lien release (aka lien cancellation)?

What is a lien release (aka lien cancellation)?